For the 24 hours to 23:00 GMT, the EUR declined 0.43% against the USD and closed at 1.3466. The greenback gained ground following upbeat data from the US, suggesting that the Federal Reserve may hike its key interest rates sooner than later.

The US Bureau of Labor Statistcs revealed that the consumer price index in the US registered a rise of 2.1% on an annual basis, compared to a similar rise in the prior month. Markets were also expecting the consumer price index to advance 2.1%. Meanwhile, the housing sector data was positive, as existing home sales in the US climbed 2.6% to a seasonally adjusted annual rate of 5.04 million units in June, its highest level since October. Additionally, the housing price index in the US rose 0.4% in May, compared to a revised 0.1% rise in the previous month. Moreover, the US Richmond Fed’s manufacturing index climbed to a level of 7.0 in July, higher than market expectations of a level of 5.0 and compared to a revised level of 4.0 in the previous month.

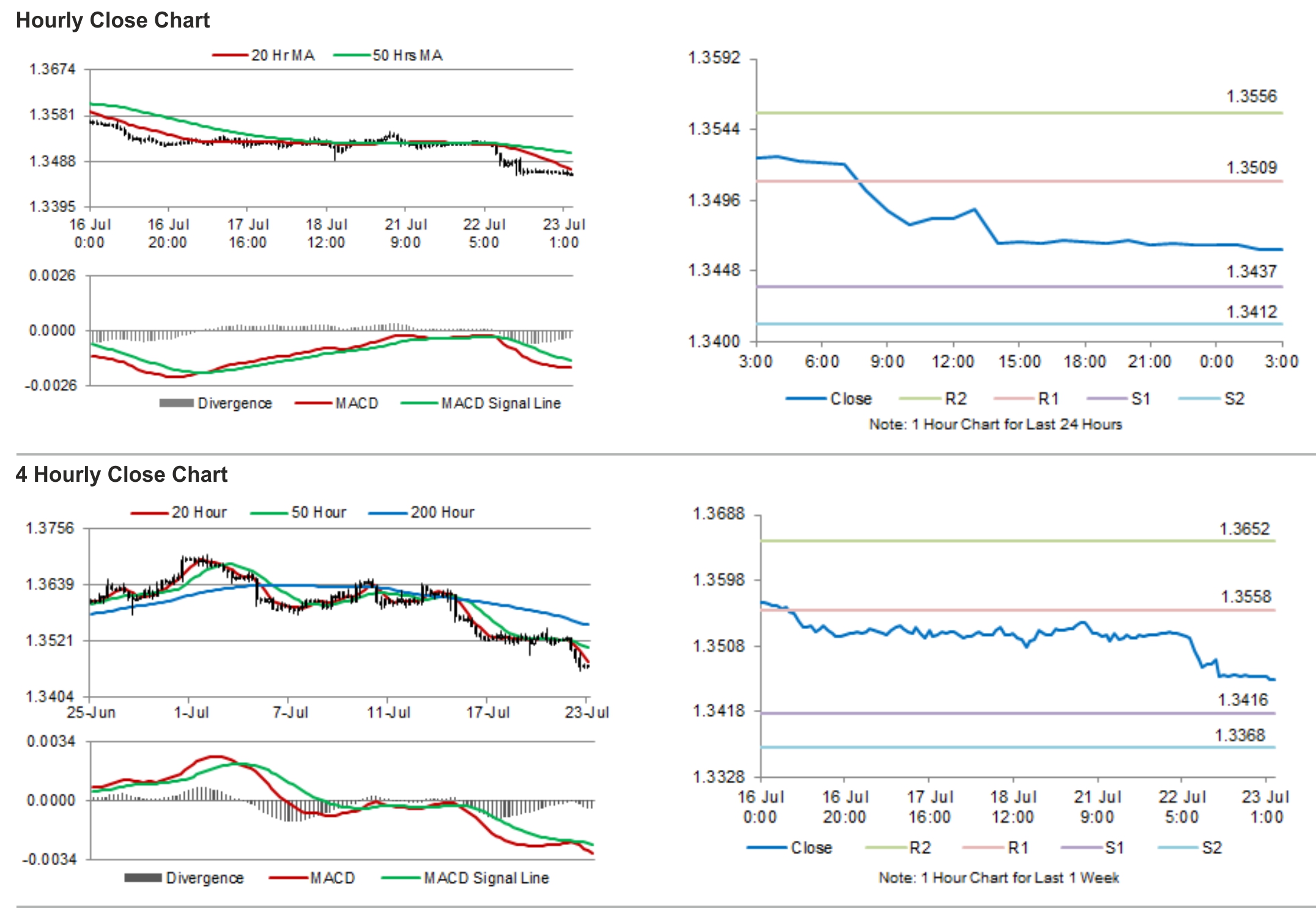

In the Asian session, at GMT0300, the pair is trading at 1.3463, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.3437, and a fall through could take it to the next support level of 1.3412. The pair is expected to find its first resistance at 1.3509, and a rise through could take it to the next resistance level of 1.3556.

Trading trends in the Euro today are expected to be determined by the release of consumer confidence data for July from the Euro-zone, slated to be released later during the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.