For the 24 hours to 23:00 GMT, the GBP marginally fell against the USD and closed at 1.7067.

In economic news, official data revealed that public sector net borrowing surplus in the UK fell to £9.5 billion in June, compared to market expectations of £9.4 billion. Net public sector borrowing surplus stood at a revised £11.9 billion in the previous month. Separately, the Confederation of British Industry (CBI), in its industrial trends survey, reported that the balance of firms reporting total order book above normal dropped to 2.0% in July, in the UK, lower than market expectations of a balance of 8.0% and compared to a balance of 11.0% of firms reporting total order book above normal in the previous month.

Yesterday, Bank of England (BoE)’s Andrew Bailey expressed concern over the increase of indebtedness of households in the UK. He further added that the policy discussion in recent weeks have been surrounded by talks on how to manage the overheating housing market in the UK.

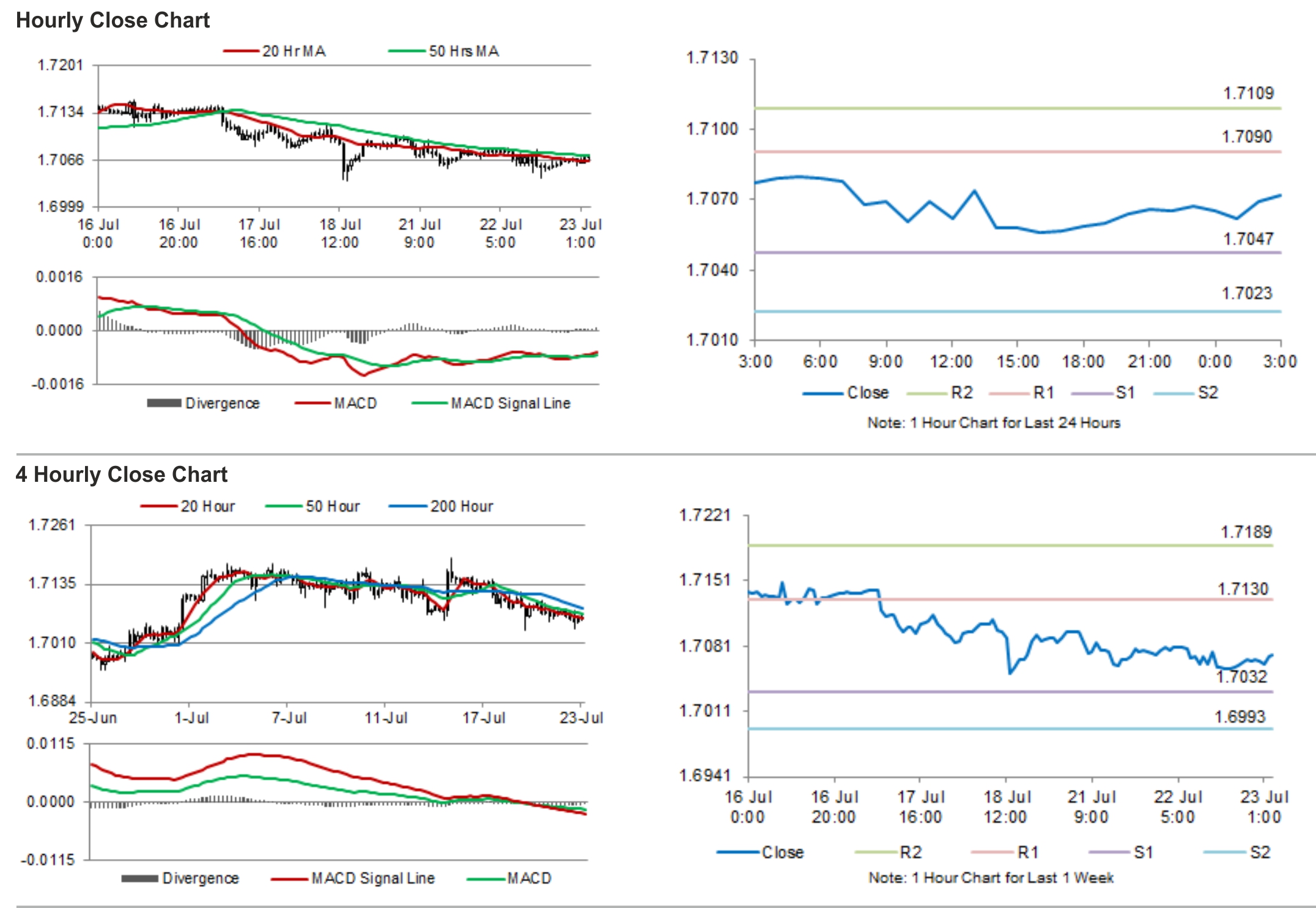

In the Asian session, at GMT0300, the pair is trading at 1.7072, with the GBP trading marginally higher from yesterday’s close.

Earlier today, in an interview, BoE’s economist Paul Fisher credited the central bank’s quantitative easing programme along with its Funding for Lending Scheme for having a strong effect on the recovery in the economy.

The pair is expected to find support at 1.7047, and a fall through could take it to the next support level of 1.7023. The pair is expected to find its first resistance at 1.709, and a rise through could take it to the next resistance level of 1.7109.

Trading trends in the Pound today are expected to be determined by the minutes from July’s BoE monetary policy meeting to be released later during the day. Meanwhile, investors would also closely follow BoE Governor Mark Carney’s speech, scheduled later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.