For the 24 hours to 23:00 GMT, the GBP fell marginally against the USD and closed at 1.6802.

In the UK, a BoE policymaker, Ian McCafferty, hinted that the central bank was inching closer to raising its interest rates even as he saw some scope of growth in the UK economy before the an interest rate hike. Furthermore, he also revealed that economic data over the summer and autumn would play a critical role in determining the exact timing in interest rate hikes.

In other economic updates, the Lloyds Bank reported that its index on UK’s employment confidence rose to a level of 4.0 in May, from previous month’s reading of 1.0.

In the Asian session, at GMT0300, the pair is trading at 1.6809, with the GBP trading marginally higher from yesterday’s close. Earlier today, a survey from the BRC showed that like-for-like retail sales in the UK economy rose 0.5% (YoY) in May, slower than a 4.2% (YoY) rise in the previous month.

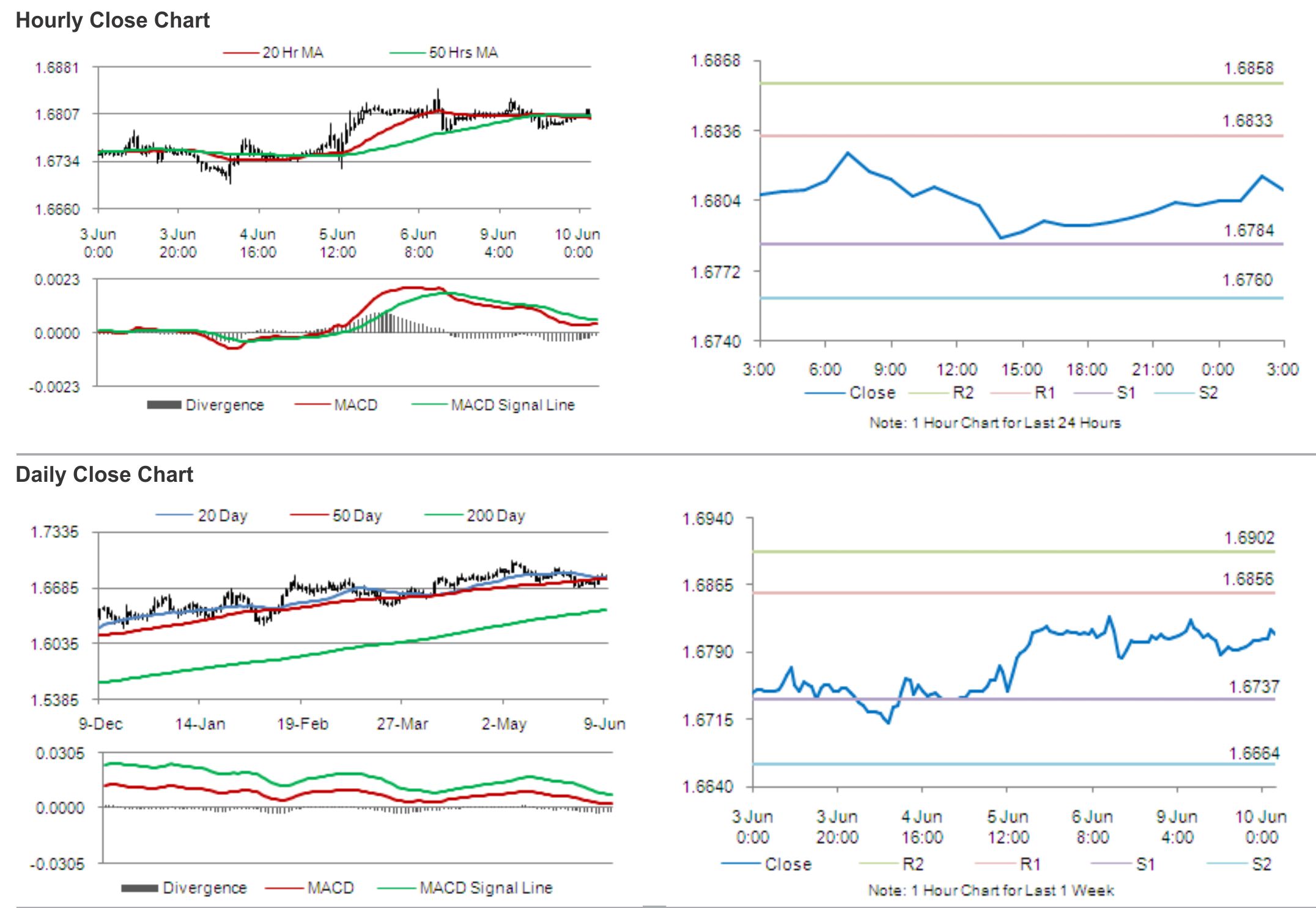

The pair is expected to find support at 1.6784, and a fall through could take it to the next support level of 1.6760. The pair is expected to find its first resistance at 1.6833, and a rise through could take it to the next resistance level of 1.6858.

Later today, market participants would eye UK’s industrial production manufacturing production and the NIESR GDP estimate data, for further cues in the British Pound.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.