For the 24 hours to 23:00 GMT, the USD marginally weakened against the JPY and closed at 102.54.

Yesterday, in Japan, BoJ Deputy Governor, Kikuo Iwata, echoed Governor, Haruhiko Kuroda’s view that, the central bank’s “qualitative and quantitative easing (QQE) policy was exerting intended effects on the economy” while projecting a rise in the nation’s exports with a recovery in the overseas economies. Separately, Japan’s consumer confidence index rose for the first time in six months to a reading of 39.3 in May. Meanwhile, Japan’s index on economy watchers’ assessment of current conditions rose more-than-expected to a level of 45.1 while its index on the economic outlook advanced to a figure of 53.8 in May.

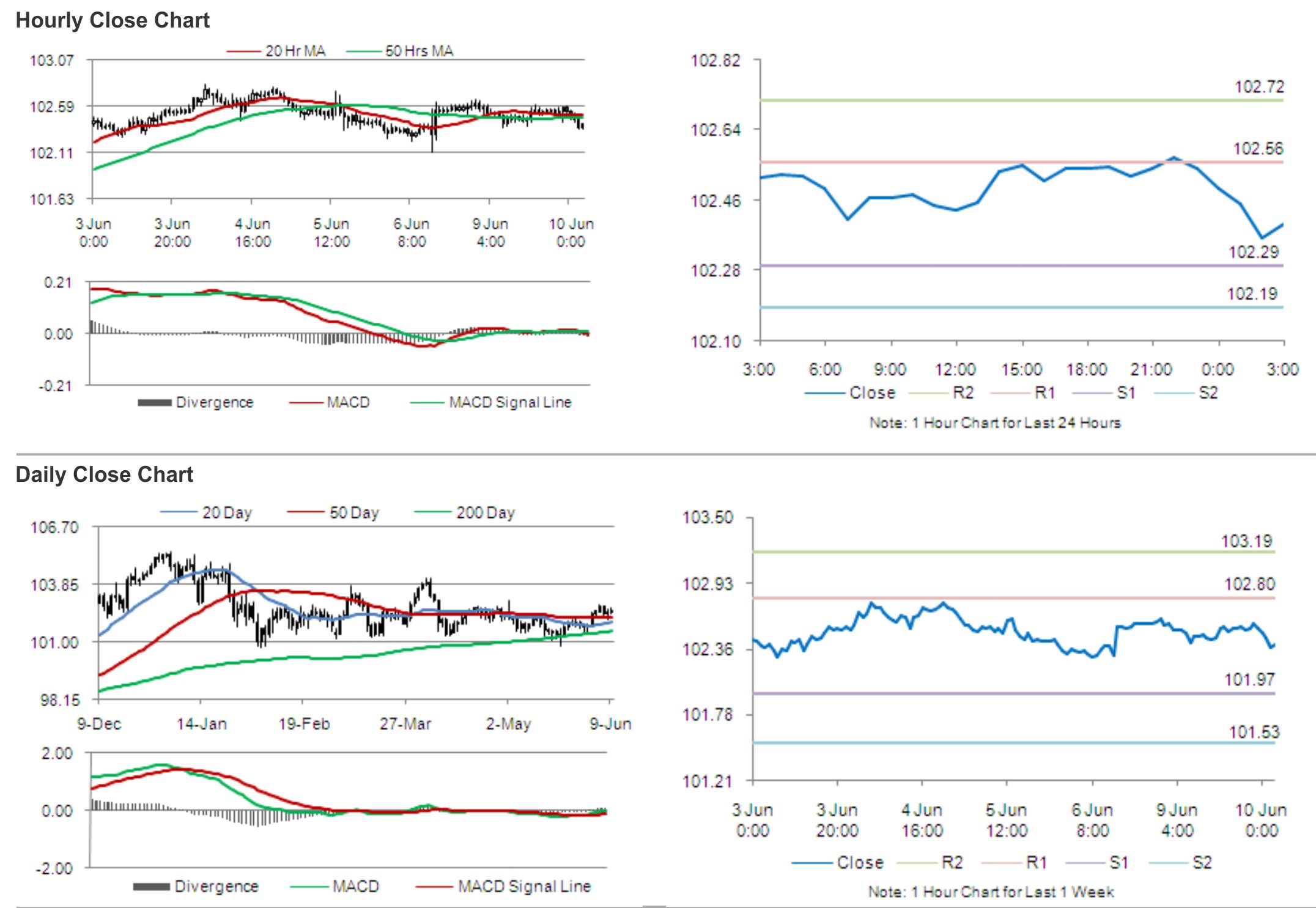

In the Asian session, at GMT0300, the pair is trading at 102.40, with the USD trading 0.14% lower from yesterday’s close.

Early morning, data showed that an index measuring tertiary industry activity in Japan fell 5.4% in April, following a 2.4% rise in the preceding month.

The pair is expected to find support at 102.29, and a fall through could take it to the next support level of 102.19. The pair is expected to find its first resistance at 102.56, and a rise through could take it to the next resistance level of 102.72.

Amid lack of major economic releases in Japan, later today, traders would eye global economic news for further guidance in the Yen.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.