For the 24 hours to 23:00 GMT, the USD weakened 0.22% against the JPY and closed at 101.76.

In the Asian session, at GMT0300, the pair is trading at 101.70, with the USD trading 0.06% lower from yesterday’s close.

Early morning, a BoJ Board member, Sayuri Shirai, opined that it would take more than two-years for the Japanese economy to achieve the central bank’s 2.0% inflation rate and as a result the BoJ’s ultra-loose monetary stimulus would continue beyond 2015.

In economic releases, retail sales in Japan declined by a seasonally adjusted 13.7% (MoM) in April, its fastest pace of decline in at least 14 years.

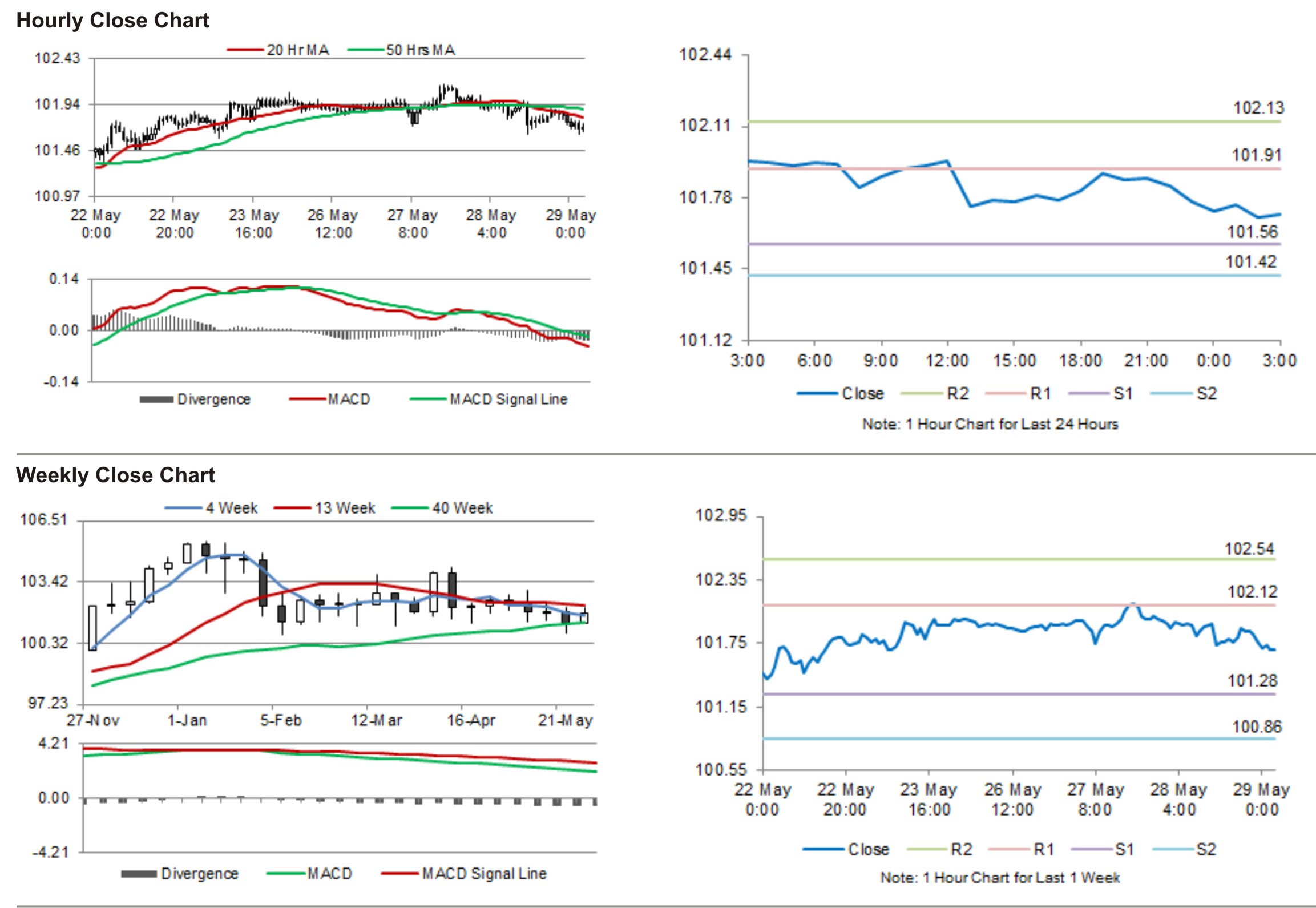

The pair is expected to find support at 101.56, and a fall through could take it to the next support level of 101.42. The pair is expected to find its first resistance at 101.91, and a rise through could take it to the next resistance level of 102.13.

With no major economic releases from Japan during the later course of the day, traders would keenly await Japan’s consumer inflation rate, unemployment rate and industrial production data, slated for release early Friday.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.