For the 24 hours to 23:00 GMT, the GBP fell 0.08% against the USD and closed at 1.4366, despite UK’s positive GDP figure.

Data showed that UK’s final GDP advanced more-than-anticipated by 0.6% QoQ in 4Q 2015, compared to market expectations for an advance of 0.5%. The preliminary figure had also recorded a rise of 0.5%. Additionally, the nation’s net consumer credit rose in line with investor expectations by £1.3 billion in February, following an advance of £1.6 billion in the previous month. On the other hand, the nation registered a record high current account deficit of £32.7 billion in 4Q 2015, following a revised current account deficit of £20.1 billion in the previous quarter. Market anticipation was for the nation to post a current account deficit of £21.2 billion. Moreover, mortgage approvals declined more-than-expected to a level of 73.1K, from a reading of 74.1K in the previous month. Investors had expected it to fall to a level of 73.5K.

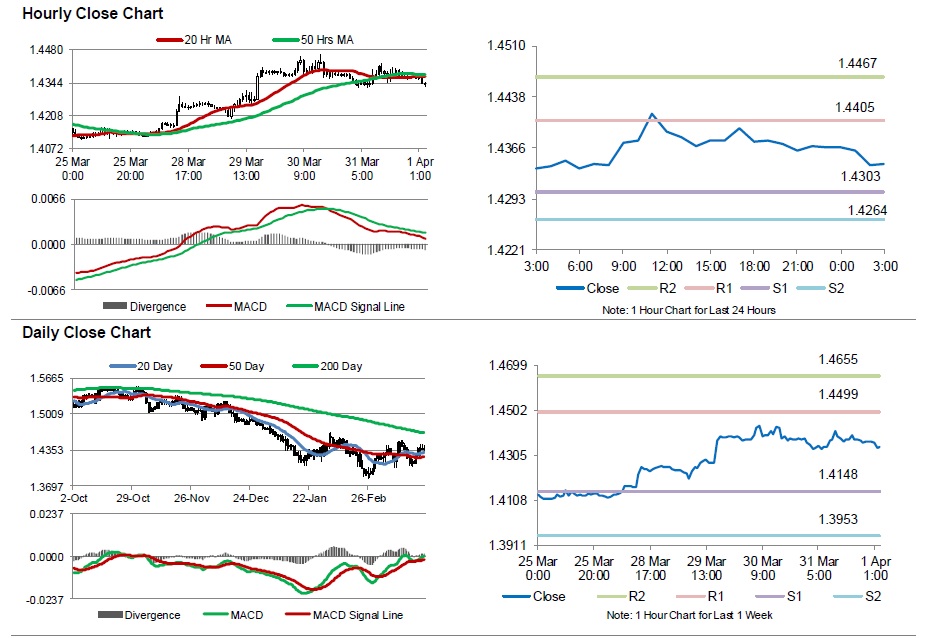

In the Asian session, at GMT0300, the pair is trading at 1.4343, with the GBP trading 0.16% lower from yesterday’s close.

The pair is expected to find support at 1.4303, and a fall through could take it to the next support level of 1.4264. The pair is expected to find its first resistance at 1.4405, and a rise through could take it to the next resistance level of 1.4467.

Going ahead, investors await the release of Britain’s Markit manufacturing PMI and nationwide house prices data, both for the month of March, due in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.