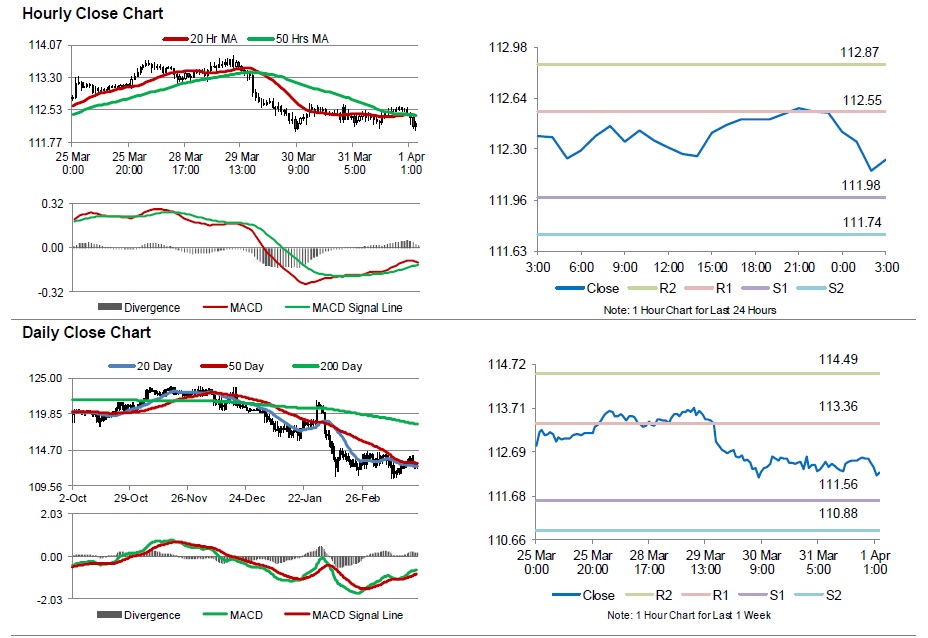

For the 24 hours to 23:00 GMT, the USD strengthened 0.08% against the JPY and closed at 112.55.

Yesterday, data indicated that Japan’s housing starts surprisingly rose by 7.8% YoY in February, compared to market expectations for a drop of 2.4%. Housing starts had registered a rise of 0.2% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 112.23, with the USD trading 0.28% lower from yesterday’s close.

Overnight data showed that the BoJ’s Q1 Tankan report, came in below expectations across the board. The central bank attributed the emerging markets slowdown as a likely contributor to the worsening of big manufacturer’s sentiment in Japan. The large manufacturing index dropped to a level of 6.0, from a reading of 12.0 in the previous quarter. The large manufacturer’s outlook index declined to a level of 3.0, compared to a reading of 7.0 in the prior quarter. Further, the large all industry capex index slid 0.9%, compared to a rise of 10.8% in the previous quarter.

Early this morning, data showed that Japan’s final Nikkei manufacturing PMI remained steady at the preliminary reading of 49.1 in March, indicating that manufacturing activity in the nation contracted for the first time in eleven months.

The pair is expected to find support at 111.98, and a fall through could take it to the next support level of 111.74. The pair is expected to find its first resistance at 112.55, and a rise through could take it to the next resistance level of 112.87.

Going ahead, investors will look forward to the release of Japan’s trade balance, consumer confidence and Eco Watchers survey data, all due next week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.