For the 24 hours to 23:00 GMT, the GBP fell 0.19% against the USD and closed at 1.4509.

On the economic front, UK’s industrial production surprisingly advanced by 2.0% MoM in April, its strongest monthly gain since July 2012, compared to a 0.3% rise in the previous month. Moreover, the nation’s manufacturing production unexpectedly advanced by 2.3% in April, compared to market expectations of a flat reading and after recording a 0.1% rise in the previous month. Additionally, Britain’s NIESR estimated gross domestic product (GDP) recorded a rise of 0.5% during the March-May 2016 period, following a revised rise of 0.4% during the February-April 2016 period.

In the Asian session, at GMT0300, the pair is trading at 1.4500, with the GBP trading 0.06% lower against the USD from yesterday’s close.

Overnight data showed that RICS house price balance index in the UK dropped to a level of 19.0 in May, from a revised reading of 39.0 in the prior month.

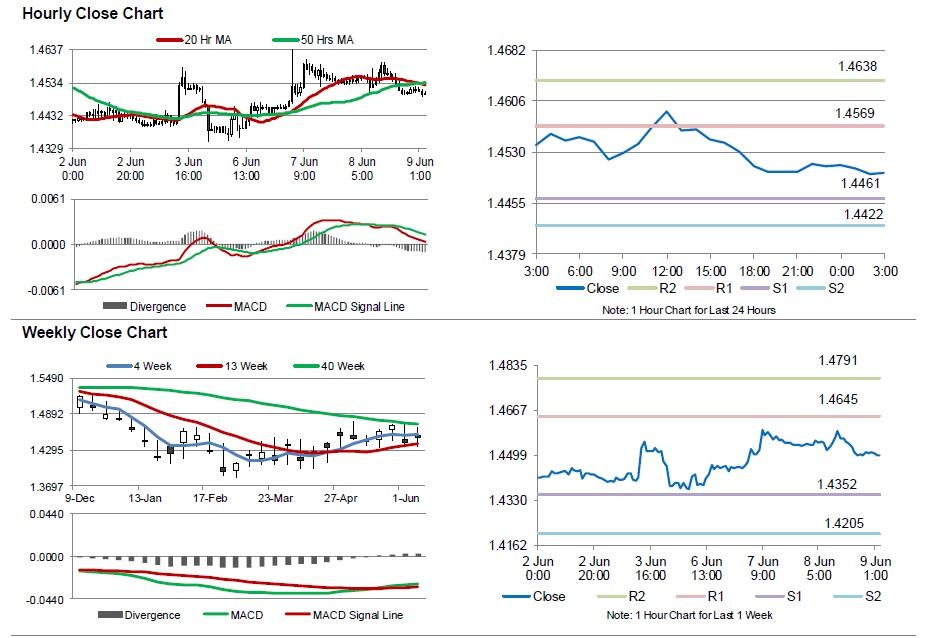

The pair is expected to find support at 1.4461, and a fall through could take it to the next support level of 1.4422. The pair is expected to find its first resistance at 1.4569, and a rise through could take it to the next resistance level of 1.4638.

Going ahead, investors will look forward to UK’s total trade balance data for April, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.

.