For the 24 hours to 23:00 GMT, the USD weakened 0.35% against the JPY and closed at 106.90.

In economic news, Japan’s Eco Watchers index for current situation fell more-than-expected to an 18-month low level of 43.0 in May, from a reading of 43.5 in the previous month. On the other hand, the nation’s outlook index advanced above expectations to a level of 47.3 in May, compared to a reading of 45.5 in the previous month.

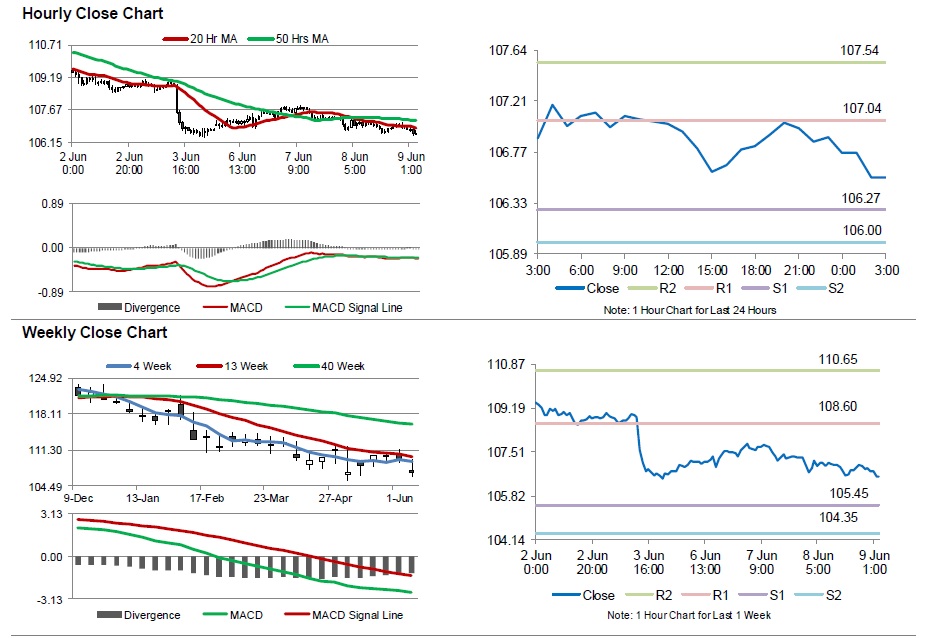

In the Asian session, at GMT0300, the pair is trading at 106.55, with the USD trading 0.33% lower against the JPY from yesterday’s close.

Overnight data showed that Japan’s machinery orders plunged 11.0% MoM in April, the biggest decline since May 2014, after recording a 5.5% rise in the previous month.

Early this morning, the Bank of Japan (BoJ) Deputy Governor, Hiroshi Nakaso, indicated the central bank’s readiness to expand monetary stimulus, if needed, in order to achieve its inflation target, amidst global economic uncertainty and signs of weakness in private consumption.

The pair is expected to find support at 106.27, and a fall through could take it to the next support level of 106.00. The pair is expected to find its first resistance at 107.04, and a rise through could take it to the next resistance level of 107.54.

Going ahead, investors will look forward to Japan’s flash machine tool orders data for May, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.