For the 24 hours to 23:00 GMT, the GBP rose tad higher against the USD and closed at 1.6982, reversing its initial losses after the IMF raised concerns over the strength of the British Pound, which may hinder the recovery process in the region. Meanwhile, the IMF backed the BoE for maintaining low interest rates and further insisted that the interest rates might need to go up quickly once inflation took off. Moreover, it also praised the UK government for implementing the right policies in order to decrease the budget deficit of the nation.

In the Asian session, at GMT0300, the pair is trading at 1.6981, with the GBP trading marginally lower from yesterday’s close.

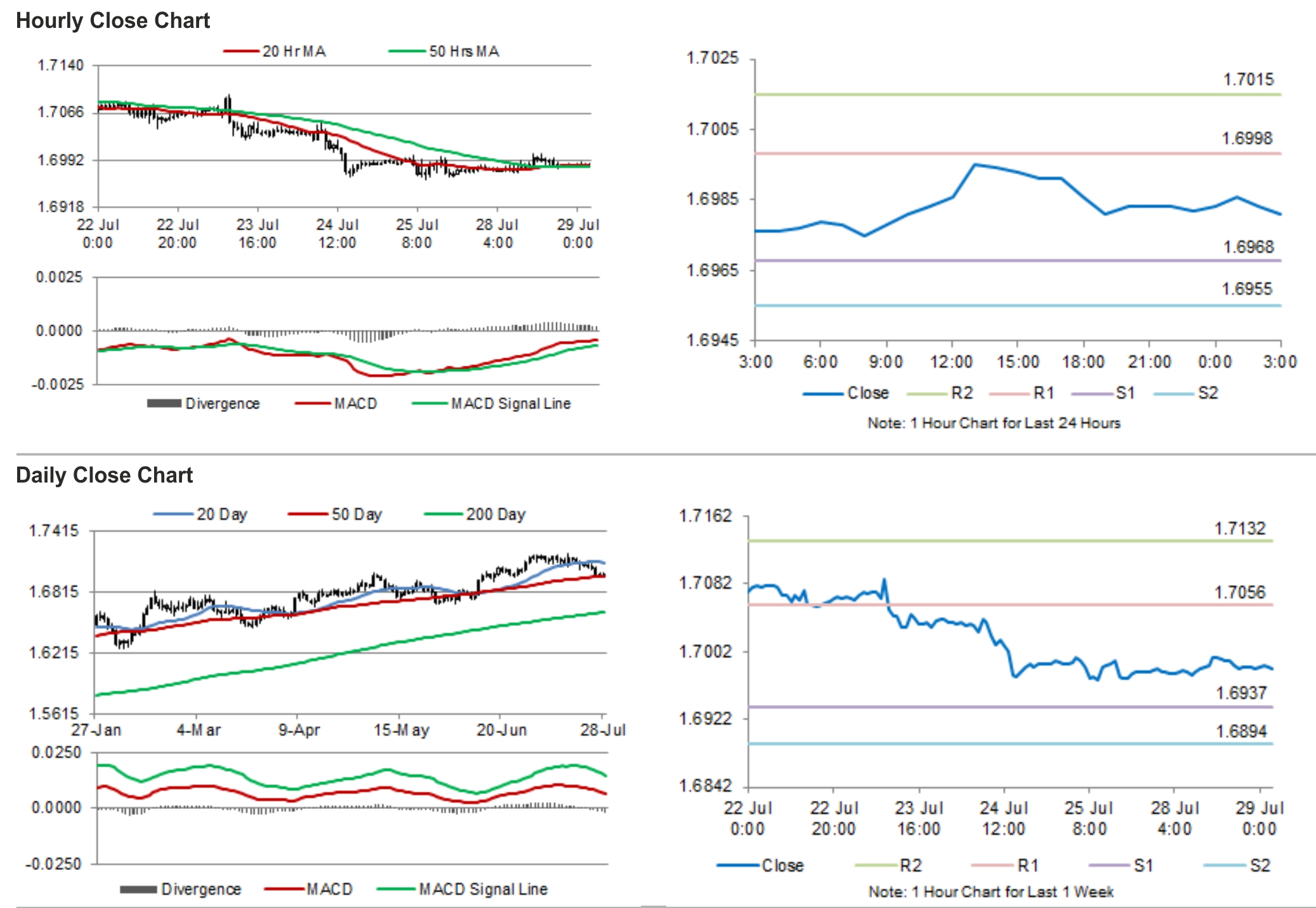

The pair is expected to find support at 1.6968, and a fall through could take it to the next support level of 1.6955. The pair is expected to find its first resistance at 1.6998, and a rise through could take it to the next resistance level of 1.7015.

Trading trends in the pair today are expected to be determined by the release of net consumer credit and mortgage approval data, from the UK later in the day. Additionally, the speech of MPC Member Broadbent would also keep investors on their toes.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.