For the 24 hours to 23:00 GMT, the USD strengthened 0.08% against the JPY and closed at 101.85.

Yesterday, Japan announced that it would impose further sanctions against Russia by banning imports of products from Crimea and by freezing assets of people taking part in destabilising Ukraine.

In the Asian session, at GMT0300, the pair is trading at 101.89, with the USD trading marginally higher from yesterday’s close.

The Japanese Yen lost ground after largely soft data from Japan released overnight. The Ministry of Internal Affairs & Communications indicated that, in June, unemployment rate in Japan rose unexpectedly to a level of 3.7%, compared to a level of 3.5% a month ago. Markets were expecting unemployment rate to remain unchanged. Similarly, on an annual basis in Japan, retail trade unexpectedly dropped 0.6% in June, compared to a decline of 0.4% in the previous month, though market anticipations were for retail trade to advance 0.8%. However, household spending in Japan registered a drop of 3.0%, on an annual basis in June, compared to a fall of 8.0% in the previous month. Markets were expecting household spending to ease 3.9%.

Early this morning, Bank of Japan Board Member, Koji Ishida stated that export condition of Japan lacks momentum at present but is likely to improve following an improvement in the global economy. He further mentioned that Japan’s economy is recovering at a moderate pace.

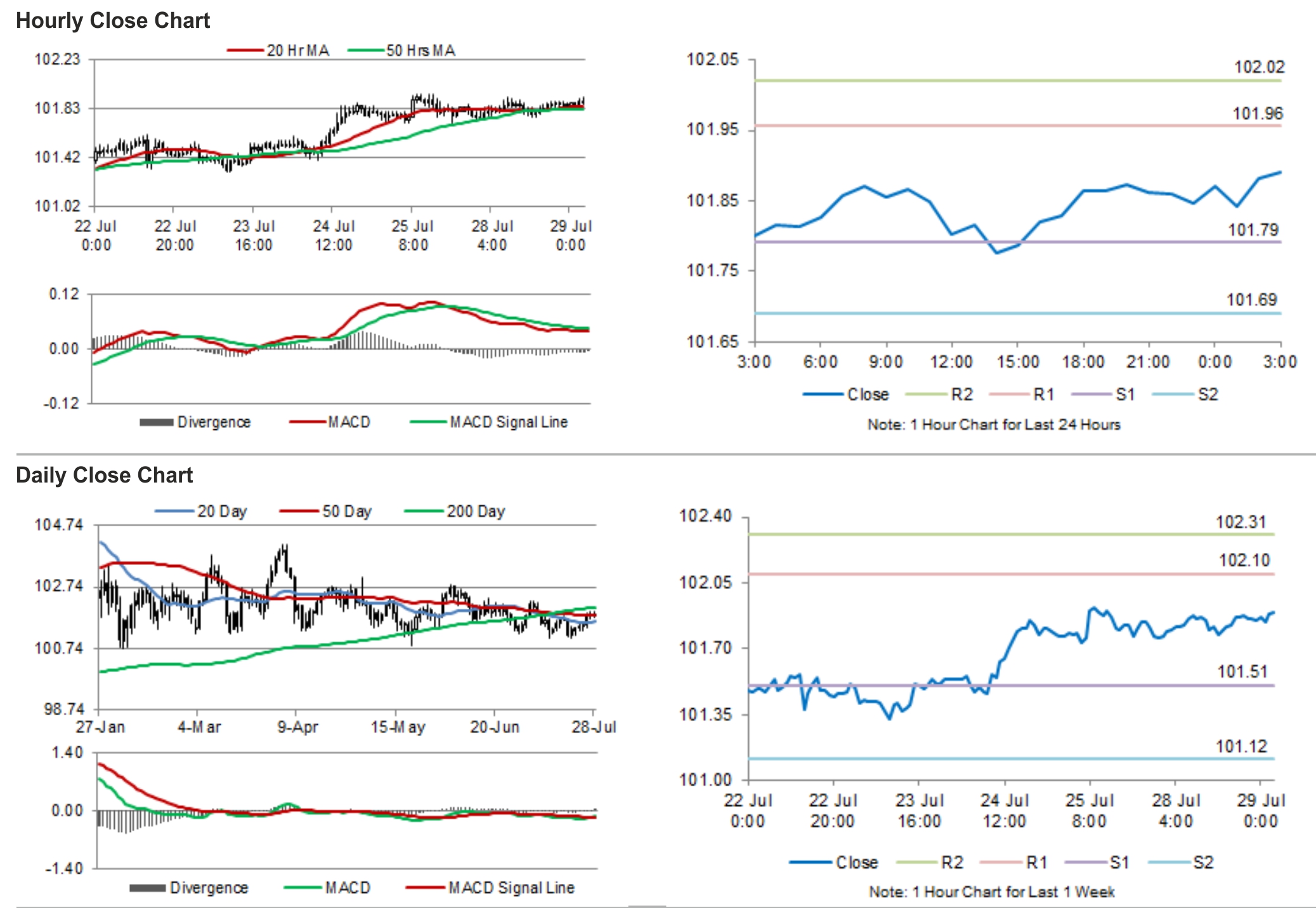

The pair is expected to find support at 101.79, and a fall through could take it to the next support level of 101.69. The pair is expected to find its first resistance at 101.96, and a rise through could take it to the next resistance level of 102.02.

Going forward, investor sentiment would mainly depend upon small business confidence data from Japan to be released in few hours along with Japan’s Industrial production data, scheduled to be released overnight.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.