For the 24 hours to 23:00 GMT, the GBP rose 0.94% against the USD and closed at 1.5635, after the BoE Governor, Mark Carney, in his speech at Treasury select committee, indicated that the central bank was moving closer for an immediate interest rate hike but added that the increase would be limited and gradual.

In economic news, UK’s consumer price inflation unexpectedly eased back to zero on a monthly basis in June, falling back from a level of 0.1% registered in May.

In the Asian session, at GMT0300, the pair is trading at 1.5644, with the GBP trading 0.06% higher from yesterday’s close.

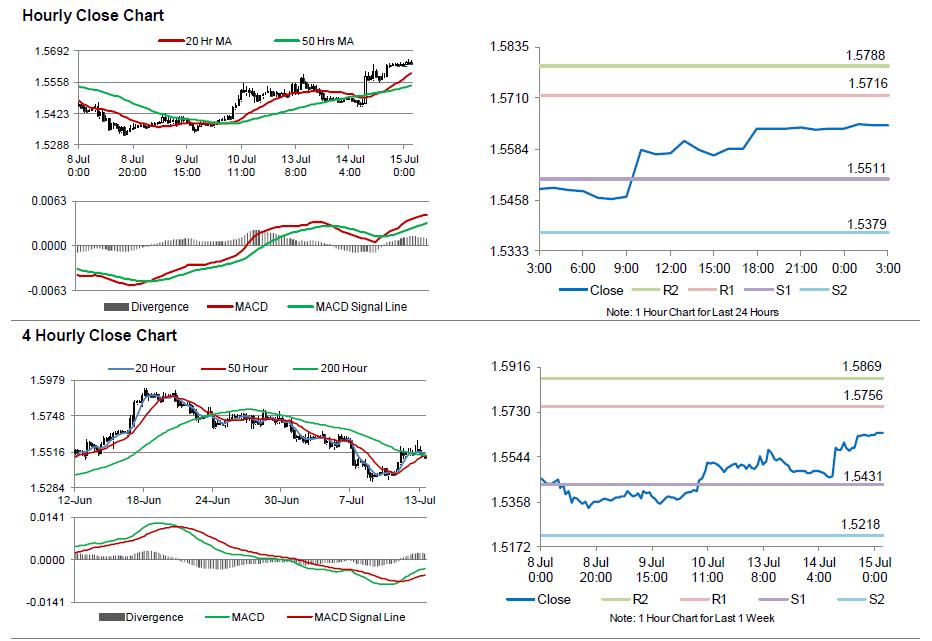

The pair is expected to find support at 1.5511, and a fall through could take it to the next support level of 1.5379. The pair is expected to find its first resistance at 1.5716, and a rise through could take it to the next resistance level of 1.5788.

Going forward, investors will closely monitor Britain’s ILO employment data, scheduled in a few hours for further cues, which is expected to remain unchanged at 5.5%.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.