For the 24 hours to 23:00 GMT, the USD weakened 0.18% against the JPY and closed at 123.36.

In the Asian session, at GMT0300, the pair is trading at 123.45, with the USD trading 0.07% higher from yesterday’s close.

Earlier today, the BoJ, in its monetary policy statement, refrained from changing its annual monetary stimulus of ¥80 trillion, in order to revive the nation’s economy and to attain its 2% inflation target through purchases of government bonds and risky assets.

Meanwhile, the central bank slashed Japan’s GDP growth forecast to 1.7% for the year ending in March 2016, from 2% estimated in April, citing weak exports and household spending.

It also downgraded the nation’s 2015 inflation forecast to 0.7%, from 0.8%.

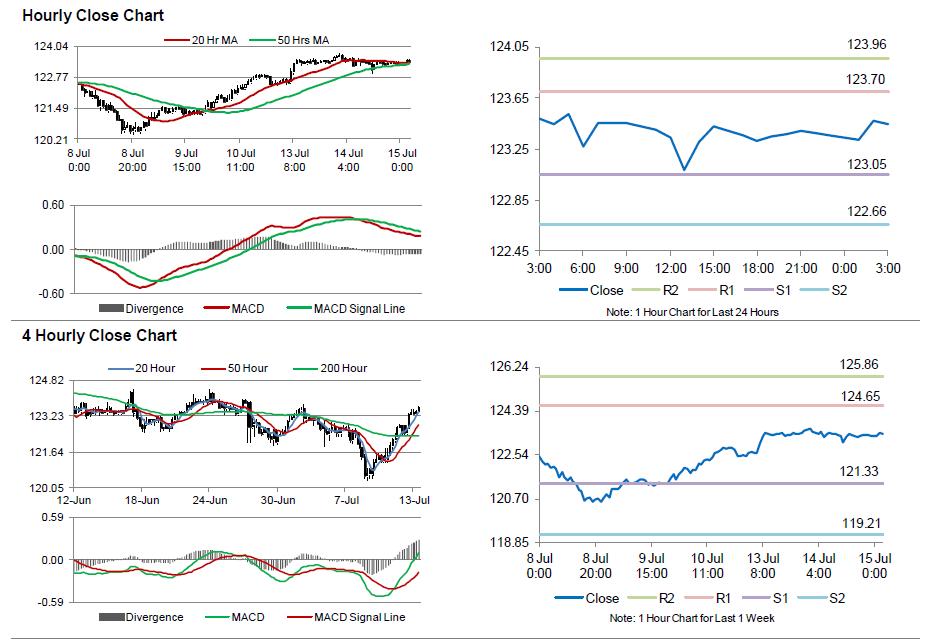

The pair is expected to find support at 123.05, and a fall through could take it to the next support level of 122.66. The pair is expected to find its first resistance at 123.70, and a rise through could take it to the next resistance level of 123.96.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.