For the 24 hours to 23:00 GMT, GBP rose 0.11% against the USD and closed at 1.6675, after the Bank of England (BoE) policymaker, Ian McCafferty stated that market expectations for a rate hike in spring of 2015 are “not unreasonable”, adding that the exact timing depends on the pace of “recovery over the course of the next 6 to 12 months or so.”

Separately, another BoE policymaker, Martin Weale, hinted that an interest rate hike in the near or medium term would be gradual and limited. Furthermore, he reiterated McCafferty’s view that the pace of wage growth in Britain would influence the central bank’s decision for an interest rate hike.

The British Pound received further support after mortgage approvals in the UK climbed to a six-year high, and the CBI survey retail sales hit its strongest level since June 2012. The BBA mortgage approvals in the UK rose more-than-expected to 49,972 in January, compared to an increase of 47,086 registered in the preceding month. Additionally, the CBI distributive trades survey – realized in the UK jumped to a reading of 37.0 in February, from preceding month’s level of 14.0.

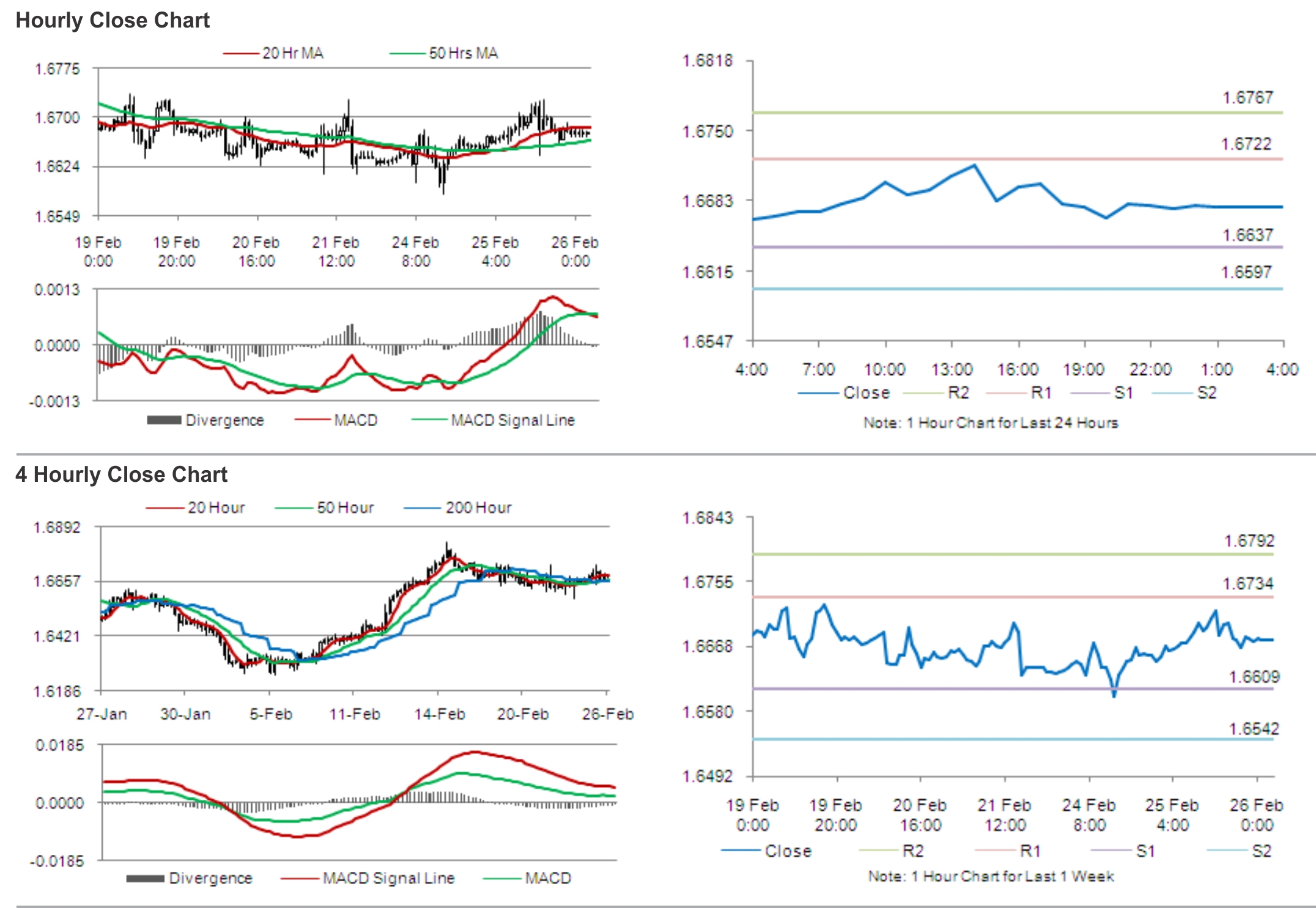

In the Asian session, at GMT0400, the pair is trading at 1.6677, with the GBP trading tad higher from yesterday’s close.

The pair is expected to find support at 1.6637, and a fall through could take it to the next support level of 1.6597. The pair is expected to find its first resistance at 1.6722, and a rise through could take it to the next resistance level of 1.6767.

Traders keenly await UK’s GDP data, which is widely expected to register an annual growth in the fourth quarter. Market participants also await the BoE MPC member, Ben Broadbent’s speech for further cues in the UK Pound.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.