For the 24 hours to 23:00 GMT, the USD weakened 0.35% against the JPY and closed at 102.15.

In the Asian session, at GMT0400, the pair is trading at 102.33, with the USD trading 0.18% higher from yesterday’s close.

Earlier today, the Bank of Japan (BoJ) Governor, Haruhiko Kuroda, in a speech at the parliament, indicated that the Japanese “economy is recovering moderately” and “is on track towards achieving a 2% inflation target.” Separately, a BoJ Board member, Koji Ishida dismissed concerns on the impact of a sales tax hike in April on Japan’s economy by stating that “recovery trend would not be lost even if growth briefly slips into a contraction phase in the April-June quarter.” Furthermore, he added that the government’s ¥5.5 trillion economic stimulus along with a pick-up in exports and corporate capital expenditures could keep the economy from falling back.

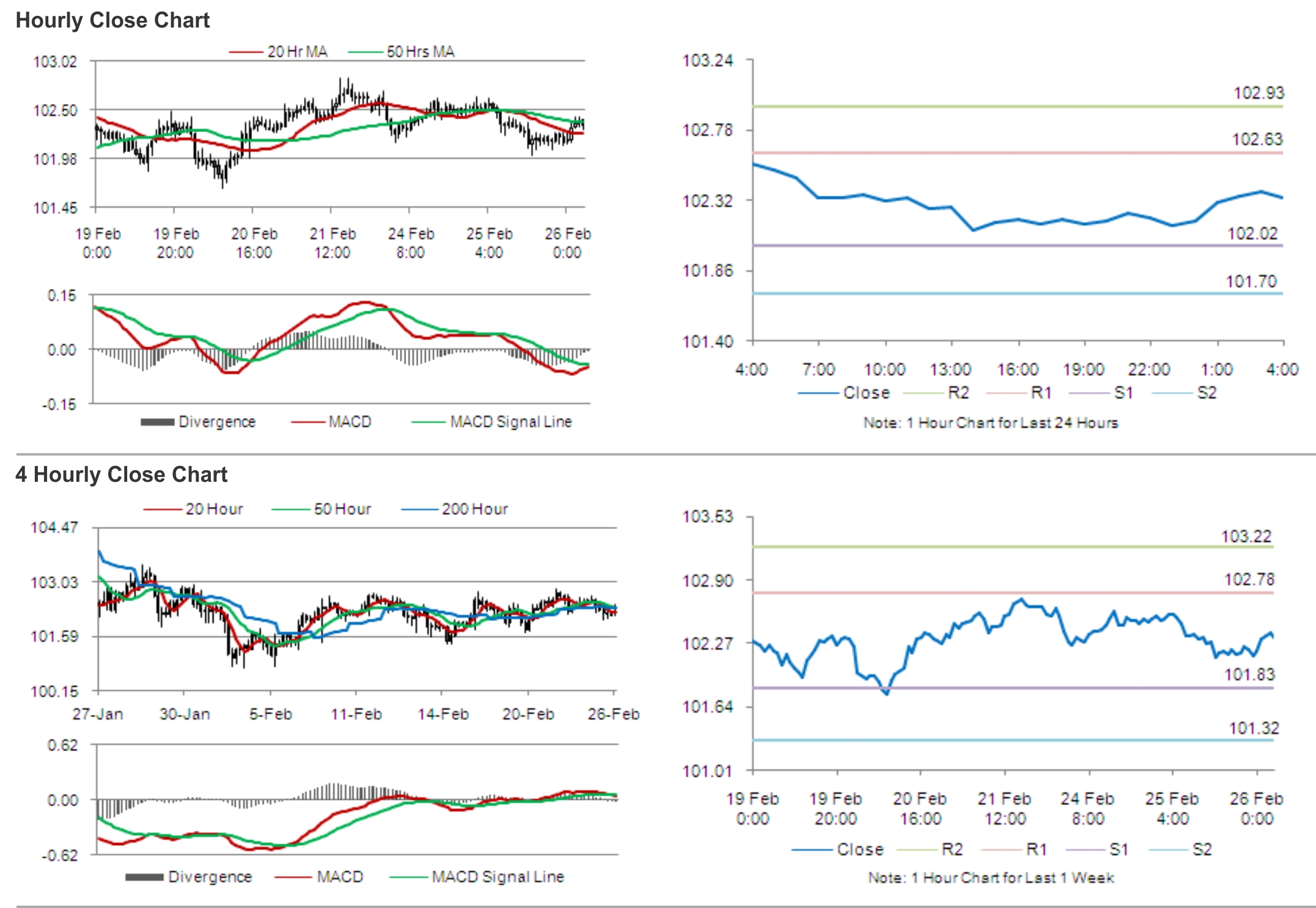

The pair is expected to find support at 102.02, and a fall through could take it to the next support level of 101.70. The pair is expected to find its first resistance at 102.63, and a rise through could take it to the next resistance level of 102.93.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.