For the 24 hours to 23:00 GMT, the GBP rose 0.08% against the USD and closed at 1.6108, following upbeat data from the UK.

The industrial production in the UK expanded in July, marking its fastest pace in 5 months, thus pointing momentum in the recovery of Britain economy. The industrial production rose 0.5%, on a monthly basis in July, beating market expectations of 0.2% rise, following 0.3% increase registered in the prior month. Also, the manufacturing production in the nation advanced 0.3%, on a monthly basis in July, matching market estimations. It had registered a similar rise in the previous month.

Additionally, the leading think tank NIESR, raised its monthly estimate of the UK GDP to 0.6% for the three months ended in August, compared to a revised rise of 0.5% for three months to July. On the other hand, the total trade deficit in the UK widened to £3.3 billion in July, compared to £2.5 billion in the previous month. Market anticipations were for the nation to record a total trade deficit of £2.3 billion.

Separately, the BoE Governor, Mark Carney, indicated that the central bank would meet its inflation and employment objectives if it starts to raise its benchmark rates in early 2015. He further mentioned that the rate at which wages rise over coming months would be vital to determine the exact timing of the first interest rate move.

In the Asian session, at GMT0300, the pair is trading at 1.6123, with the GBP trading 0.09% higher from yesterday’s close.

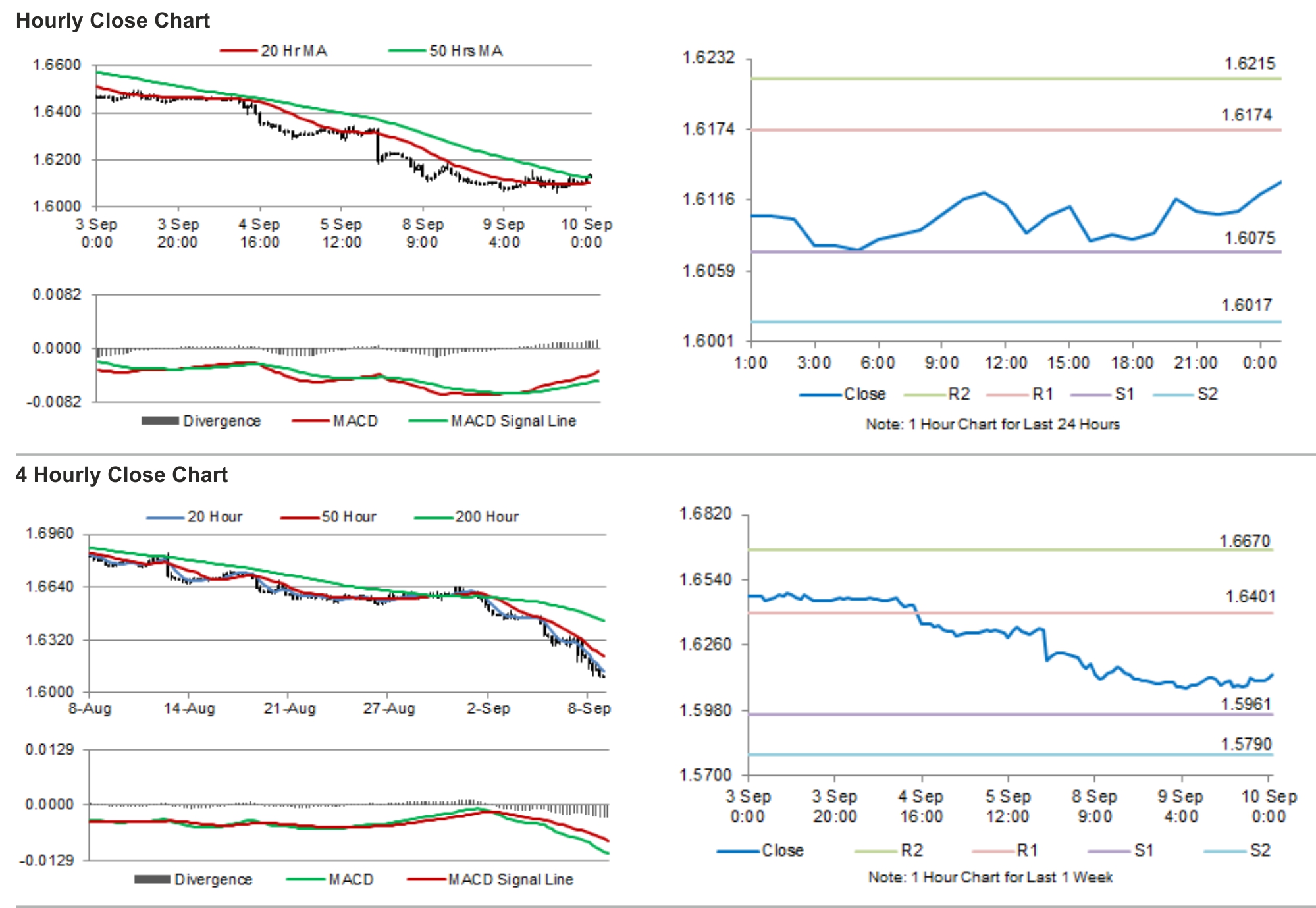

The pair is expected to find support at 1.6069, and a fall through could take it to the next support level of 1.6014. The pair is expected to find its first resistance at 1.6168, and a rise through could take it to the next resistance level of 1.6212.

Trading trends in the Pound today would be determined by the BoE’s testimony on the August inflation report.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.