For the 24 hours to 23:00 GMT, the USD strengthened 0.19% against the JPY and closed at 106.20. The Japanese Yen lost ground after the consumer confidence index in Japan unexpectedly eased to 41.2 in August, lower than market expectations for a rise to 42.3 and compared to a level of 41.5 registered in the previous month. In other economic data, machine tool orders in Japan climbed 35.6%, on an annual basis in August, against a 37.7% increase in July.

In the Asian session, at GMT0300, the pair is trading at 106.29, with the USD trading 0.08% higher from yesterday’s close.

Earlier today, data indicated that machine orders in Japan rose 3.5%, on a monthly basis in July, lesser than market expectations for a rise of 4.0%, following an increase of 8.8% registered in the previous month. Additionally, Japan’s PPI unexpectedly fell 0.2%, on a monthly basis in August.

Separately, the BoJ Deputy Governor, Kikuo Iwata, stated that the Japanese economy is on track and continues to recover moderately, amid increase in spending by households and companies ahead, as effects of April sales tax hike eases.

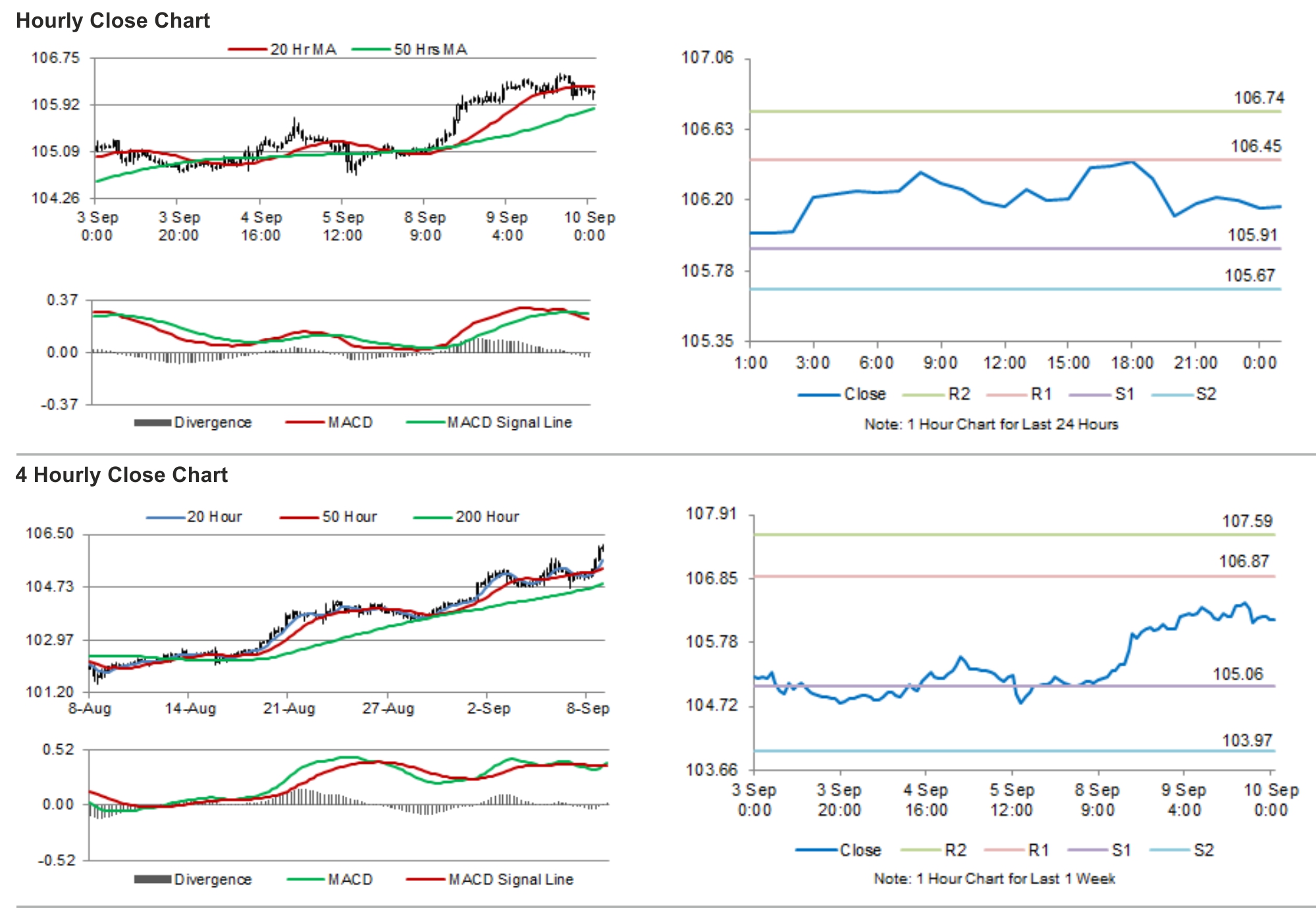

The pair is expected to find support at 106.02, and a fall through could take it to the next support level of 105.75. The pair is expected to find its first resistance at 106.52, and a rise through could take it to the next resistance level of 106.76.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.