For the 24 hours to 23:00 GMT, the GBP rose 0.62% against the USD and closed at 1.6973, after the UK Markit service PMI beat expectations and rose to a level of 58.7 in April, the highest level since December 2013. Separately, the OECD, commending UK’s accommodative monetary policy and stronger employment figures, raised its growth forecast on the British economy to 3.2% this year and 2.7% for 2015, from its six-month prior estimate of 2.4% and 2.5%, respectively. However, the organisation cautioned that soaring house prices in the UK economy could pose the biggest risk to the nation’s recovery.

In the Asian session, at GMT0300, the pair is trading at 1.6970, with the GBP trading marginally lower from yesterday’s close.

Earlier today, the BRC shop price index for the UK economy registered a 1.4% (YoY) fall for the 12th consecutive month in April.

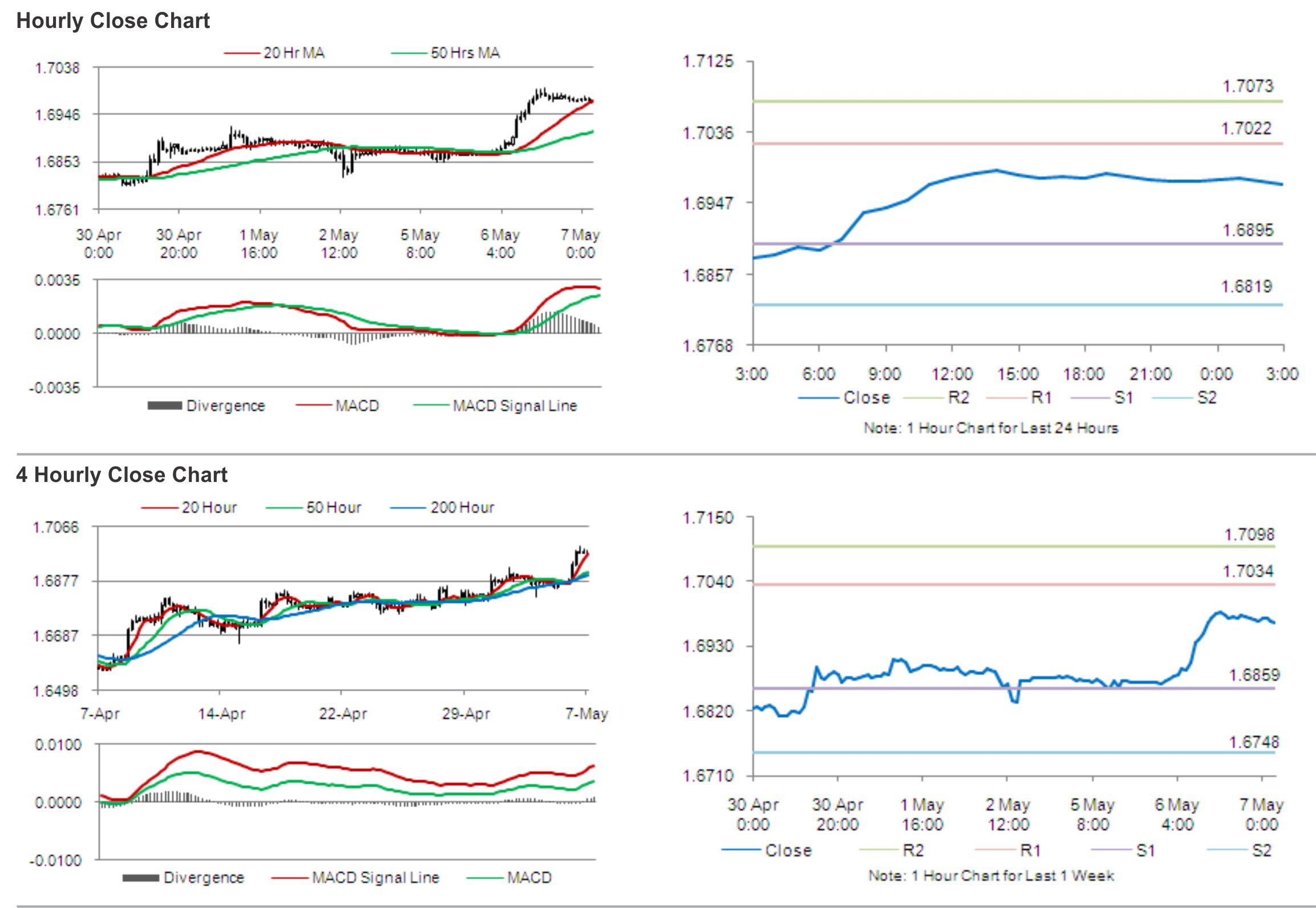

The pair is expected to find support at 1.6895, and a fall through could take it to the next support level of 1.6819. The pair is expected to find its first resistance at 1.7022, and a rise through could take it to the next resistance level of 1.7073.

Later today, the Halifax and the RICS are expected to publish separate reports on the UK’s housing sector.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.