For the 24 hours to 23:00 GMT, the USD weakened 0.46% against the JPY and closed at 101.68, following the releases of lacklustre US trade balance data for March.

In economic news, the OECD slashed its growth projections for the Japanese economy to 1.2% this year, down from its November forecast of 1.5%. Furthermore, the Paris-based agency urged Japan’s government to promote structural reforms and raise the nation’s consumption tax rate to 10% next year while warning that the nation risked facing a slowdown in economic growth if wage growth does not keep up with inflation growth.

In the Asian session, at GMT0300, the pair is trading at 101.60, with the USD trading 0.08% lower from yesterday’s close.

Earlier today, minutes from the BoJ’s April 7-8 policy meeting, showed that board members expected economic recovery in Japan to continue at a moderate pace in the near future while noting that the recent hike in consumption tax may result in a decline in demand. The minutes also showed that one of the board members indicated that demand before the sales tax hike in April was larger when compared to demand before the previous sales tax hike in 1997 while another board member projected inflation to quicken from April, citing higher input costs. Separately, Markit Economics reported that its PMI on Japan’s service sector moved into the contraction territory in April with a score of 46.4.

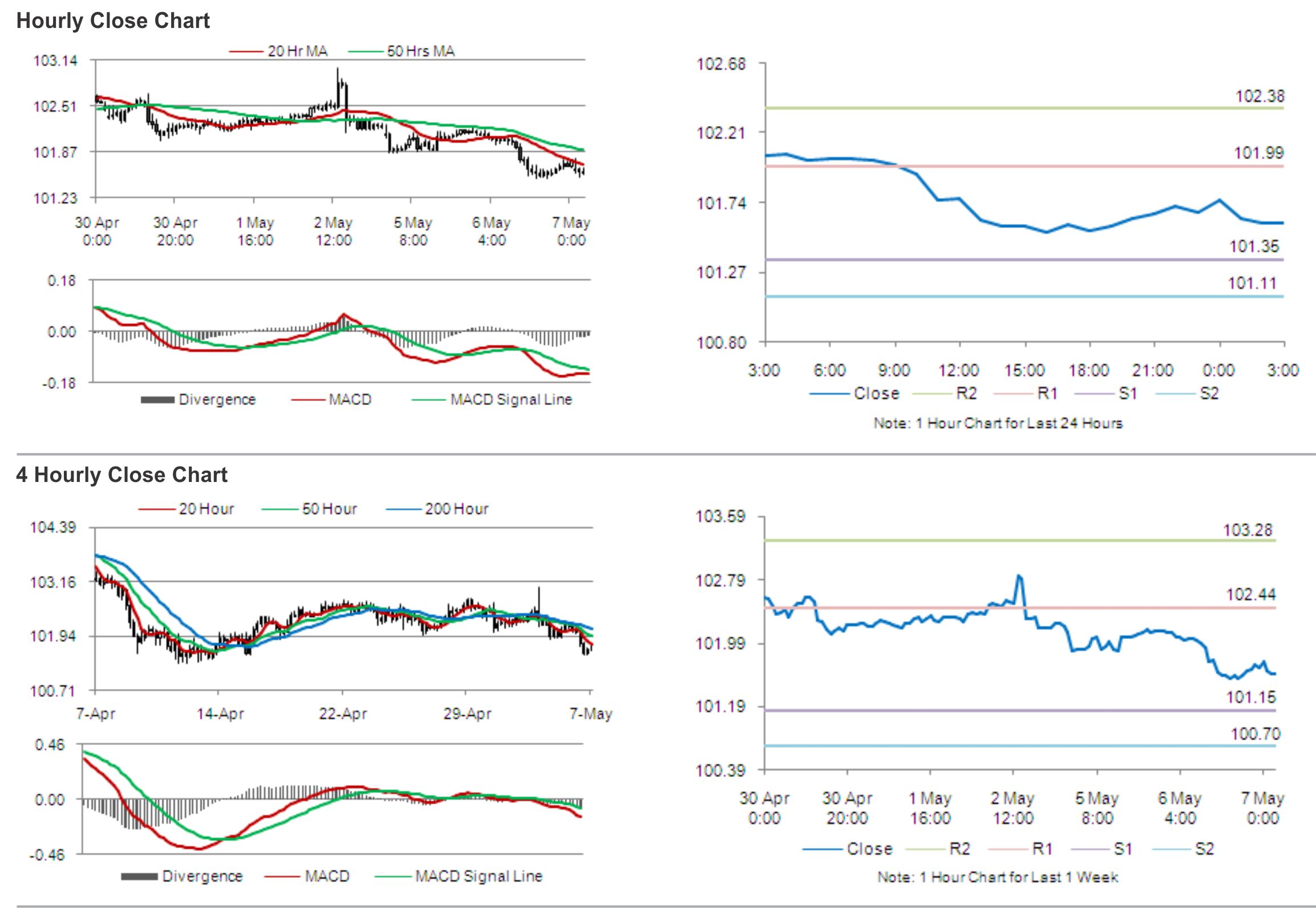

The pair is expected to find support at 101.35, and a fall through could take it to the next support level of 101.11. The pair is expected to find its first resistance at 101.99, and a rise through could take it to the next resistance level of 102.38.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.