For the 24 hours to 23:00 GMT, GBP rose 0.09% against the USD and closed at 1.6132.

In the UK, the seasonally adjusted construction Purchasing Managers’ Index declined to 56.4 in March, following 56.5 in the previous month.

According to Bank of England, housing equity withdrawal was -£7 billion for the fourth quarter of 2010, the 11th consecutive net quarterly injection and the highest level recorded since inception, and down from -£6.6 billion for the previous quarter.

Federal Reserve Chairman, Ben Bernanke indicated that Federal regulators are focusing on reforms to strengthen oversight of the nation’s financial system. Bernanke also added that closer regulation of the financial system, including supervision of financial “clearinghousesâ€, would help prevent a repeat of the 2008 financial crisis.

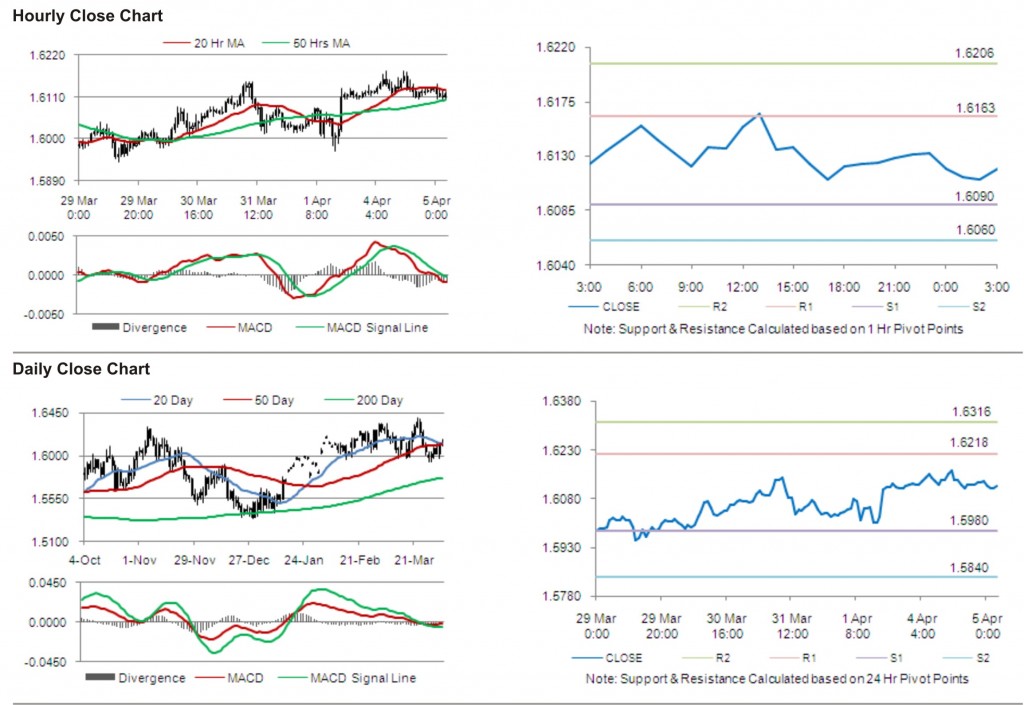

The pair opened the Asian session at 1.6132, and is trading at 1.6119 at 3.00GMT. The pair is trading 0.08% lower from the New York session close.

The pair has its first short term resistance at 1.6163, followed by the next resistance at 1.6206. The first support is at 1.6090, with the subsequent support at 1.6060.

Trading trends in the pair today are expected to be determined by purchasing manager index services and Halifax house price index data, later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.