For the 24 hours to 23:00 GMT, USD weakened 0.12% against the JPY and closed at 84.11.

Chicago Federal Reserve Bank President, Charles Evans stated that the Fed’s decision to purchase $600 billion in large scale assets is the “right amount” and that accommodative policy is appropriate as long as core inflation remains in the 1.5% range.

Additionally, St. Louis Fed Research Director, Christopher Waller stated that the US central bank is likely to buy all of the bonds it has said it will by June 30 and reinvest securities for a while after that before beginning to tighten financial conditions.

In the Asian session at 3:00GMT, the pair is trading higher from the New York close, by 0.21%, at 84.29.

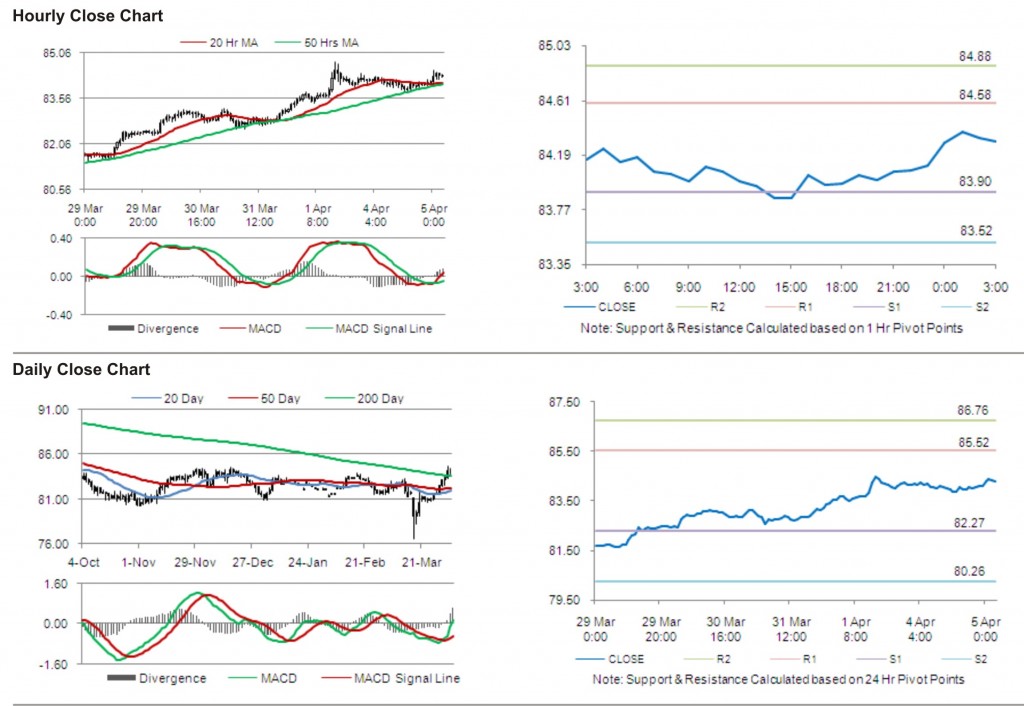

The first short term resistance is at 84.58, followed by 84.88. The pair is expected to find support at 83.90 and the subsequent support level at 83.52.

Trading trends in the pair today are expected to be determined by machine tool orders

in Japan, in the day ahead.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.