For the 24 hours to 23:00 GMT, GBP fell 0.16% against the USD and closed at 1.6303, after UK manufacturing unexpectedly dropped in June and the trade deficit widened, and as the worst civil unrest in 30 years added to the concerns that the economic recovery is faltering.

In the UK, the manufacturing output fell 0.4% (M-o-M) in June, from a 1.8% (M-o-M) growth in May. Meanwhile, the industrial output came in unchanged in June, compared to a 0.8% gain in May. Additionally, the total trade deficit expanded unexpectedly to £4.5 billion in June, following a revised trade deficit of £4.0 billion in May. Also, the visible trade deficit widened to £8.9 billion in June, from a deficit of £8.5 billion in May. The National Institute of Economic and Social Research (NIESR) reported that, the Gross Domestic Product grew 0.6% in the three months ended in July, following a 0.2% growth registered in the three months ended in June.

The pair opened the Asian session at 1.6303, and is trading at 1.6295 at 3.00GMT. The pair is trading 0.05% lower from yesterday’s close at 23:00 GMT.

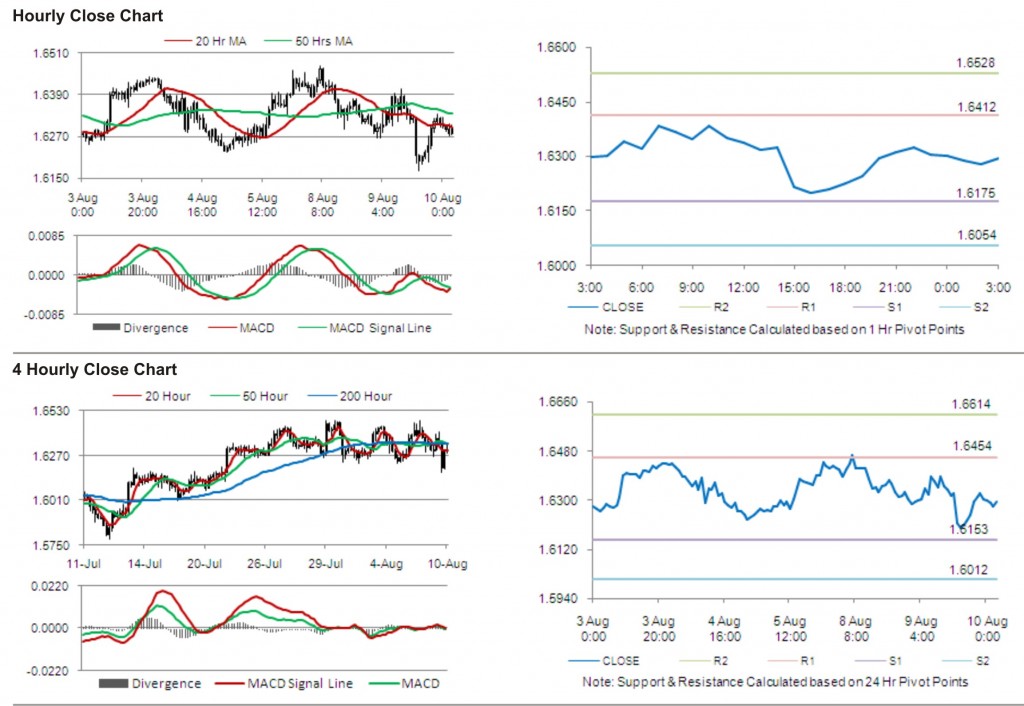

The pair has its first short term resistance at 1.6412, followed by the next resistance at 1.6528. The first support is at 1.6175, with the subsequent support at 1.6054.

The Bank of England’s Governor King speech is likely to receive increased market attention, with other UK data due to be released later today.

The currency pair is showing convergence at its 20 Hr moving average and is trading below its 50 Hr moving average.