For the 24 hours to 23:00 GMT, the GBP fell 0.06% against the USD and closed at 1.5157.

In economic news, number of mortgage approvals in the UK advanced more than expected to a level of 71.0K, hitting its 19-month high in August and compared to prior month’s revised reading of 69.0K, thereby providing further indication that the nation’s housing market is heating up. Meanwhile, net lending secured on dwellings also picked up to a level of £3.4 billion in August, from an upwardly revised print of £2.8 billion in July, notching its biggest increase since May 2008.

In the Asian session, at GMT0300, the pair is trading at 1.5158, with the GBP trading marginally higher from yesterday’s close.

Overnight data showed that UK’s Gfk consumer confidence index slipped more than expected to a level of 3.0 in September, from 7.0 in August, as an economic slowdown in China and ongoing migrant crisis hit the consumer morale.

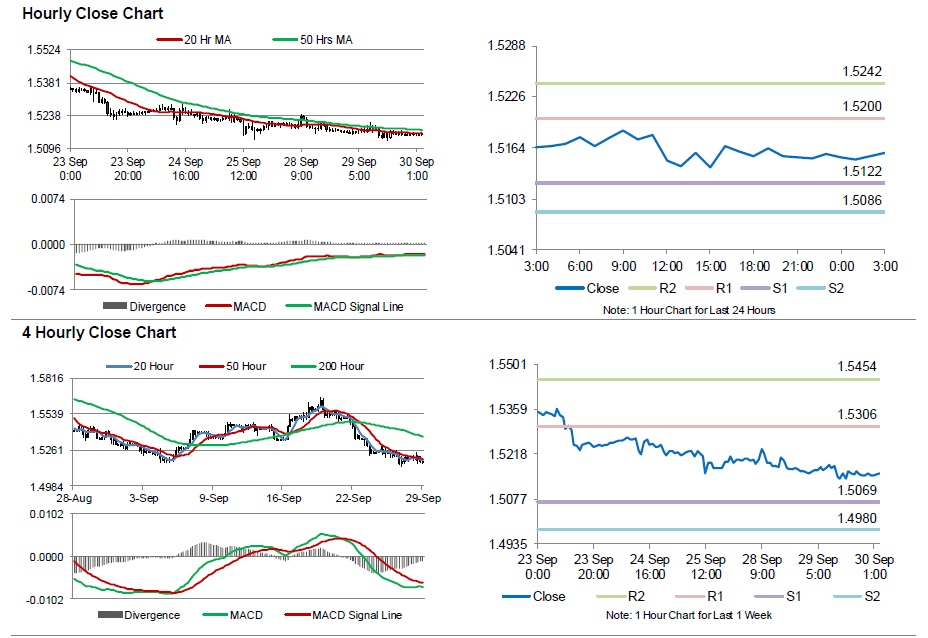

The pair is expected to find support at 1.5122, and a fall through could take it to the next support level of 1.5086. The pair is expected to find its first resistance at 1.5200, and a rise through could take it to the next resistance level of 1.5242.

Moving forward, investors would concentrate on the final estimate of Britain’s Q2 GDP growth data, scheduled in a few hours, to gauge the strength of the nation’s economy.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.