For the 24 hours to 23:00 GMT, the USD weakened 0.10% against the JPY and closed at 119.81, amid a mixed set of data from Japan.

Japan’s small business confidence index rose to 49.0 in September, from 48.8 in August. In additions, sales of large retailers in Japan increased by 1.8% in August, after recording a growth of 2.1% in July.

In the Asian session, at GMT0300, the pair is trading at 119.79, with the USD trading marginally lower from yesterday’s close.

Overnight data showed that the nation’s industrial production fell 0.5% MoM in August, while the country’s retail trade remained flat on a monthly basis in the last month.

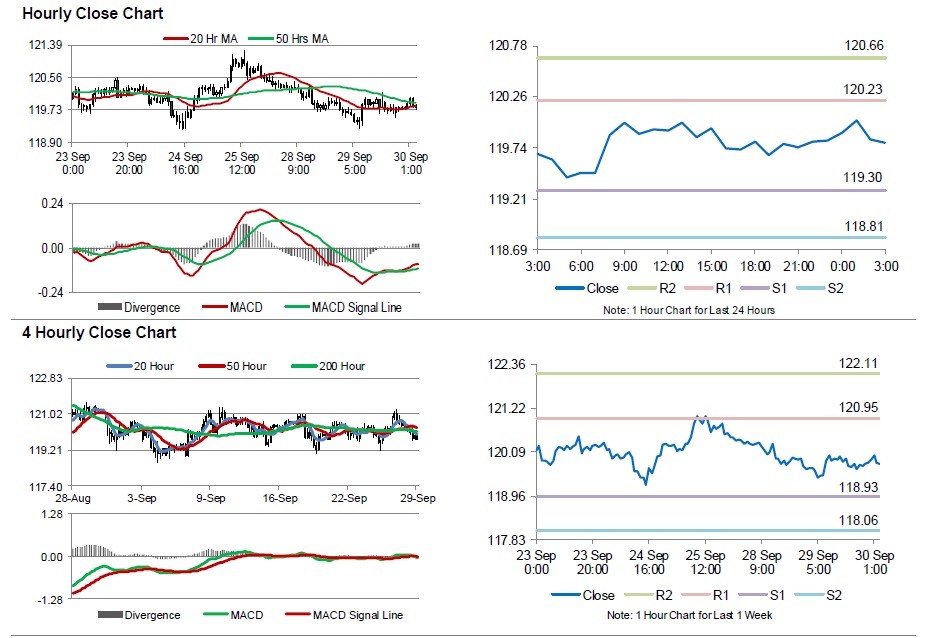

The pair is expected to find support at 119.30, and a fall through could take it to the next support level of 118.81. The pair is expected to find its first resistance at 120.23, and a rise through could take it to the next resistance level of 120.66.

Moving ahead, investors await the release of Japan’s Tankan survey data for Q3, scheduled overnight.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.