For the 24 hours to 23:00 GMT, the GBP fell 0.07% against the USD and closed at 1.4436, after UK’s industrial and manufacturing production advanced at a less-than-expected pace in March.

Data showed that Britain’s industrial production registered a rise of 0.3%, lower than market expectations for a rise of 0.5%. In the prior month, industrial production had dropped by a revised 0.2%. Moreover, manufacturing output rose 0.1%, compared to market expectations for an advance of 0.3% and following a revised drop of 0.9% in the previous month, thus fuelling concerns over the health of the nation’s economy.

In other economic news, UK’s reputed think-tank NIESR, estimated that the nation’s GDP grew by 0.3% during the three months ended April 2016, down from the revised reading of 0.4% during the first three months of 2016, mainly due to the heightened uncertainty surrounding the impending European Union referendum.

In the Asian session, at GMT0300, the pair is trading at 1.4436, with the GBP trading flat from yesterday’s close.

Overnight data showed that, Britain’s RICS house price balance index edged lower to a level of 41.0 in April, its lowest since June 2015, compared to market expectations of a fall to a level of 35.0. In the previous month, house price balance had registered a reading of 42.0.

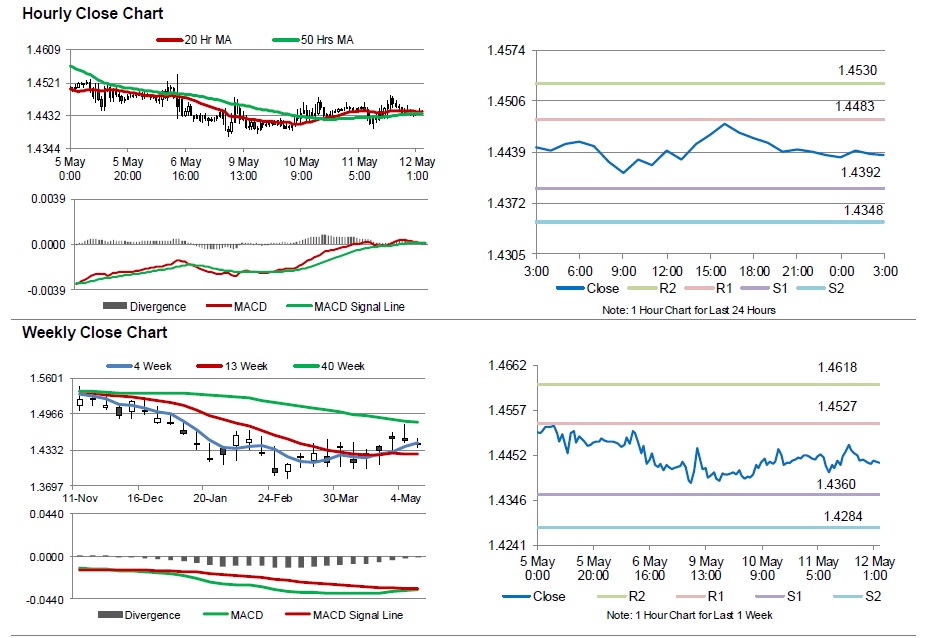

The pair is expected to find support at 1.4392, and a fall through could take it to the next support level of 1.4348. The pair is expected to find its first resistance at 1.4483, and a rise through could take it to the next resistance level of 1.4530.

Moving ahead, investors will closely watch the BoE’s interest rate decision and quarterly inflation report, due later in the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.