For the 24 hours to 23:00 GMT, the USD weakened 0.78% against the JPY and closed at 108.44.

In economic news, Japan’s preliminary leading index surprisingly rose to a level of 98.4 in March, compared to a level of 96.8 in the prior month. Market anticipation was for the index to ease to a level of 96.4. Moreover, the nation’s flash coincident index advanced in line with market expectations to a level of 111.2 in March, from a reading of 110.7 in the previous month.

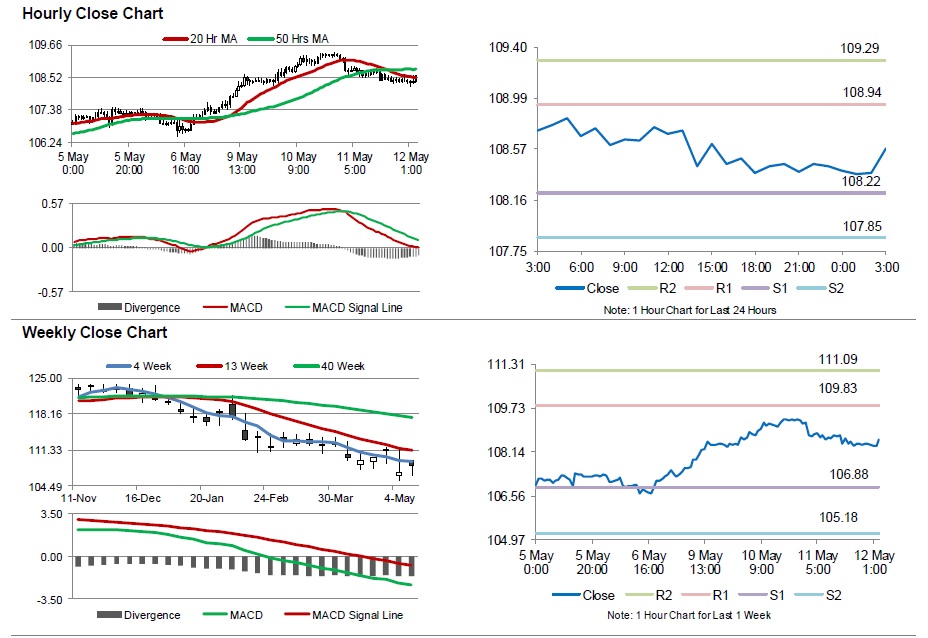

In the Asian session, at GMT0300, the pair is trading at 108.58, with the USD trading 0.13% higher from yesterday’s close.

Overnight data showed that Japan’s (BOP basis) trade surplus widened to a level of ¥927.2 billion in March, more than market expectations of a trade surplus of ¥906.0 billion. Japan had posted a (BOP basis) trade surplus of ¥425.2 billion in the prior month.

Separately, a summary of opinions of the Bank of Japan’s (BoJ) April monetary policy meeting revealed that the central bank’s decision to hold monetary policy steady was taken as several board members agreed that they should take some time to monitor the effect of the negative interest rate policy on the nation’s economy. Further, some of the policymakers stressed the need to expand monetary stimulus further, if needed to achieve the BoJ’s inflation target.

The pair is expected to find support at 108.22, and a fall through could take it to the next support level of 107.85. The pair is expected to find its first resistance at 108.94, and a rise through could take it to the next resistance level of 109.29.

Moving ahead, investors will look forward to the Japan’s Eco Watchers survey data for April, scheduled to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.