For the 24 hours to 23:00 GMT, the GBP fell 0.24% against the USD and closed at 1.5085, following dovish comments from two top officials of the BoE.

The BoE Governor, Mark Carney, indicated that the low interest rate environment is likely to continue in the UK for “some time”. Additionally, the central bank’s chief economist, Andy Haldane, stated that there are more downside risks to British economic growth and inflation than reflected in the BoE’s latest economic outlook report. He also reiterated his view that the central bank’s next move might be a rate cut rather than a rate hike as the British economy appeared to be losing momentum.

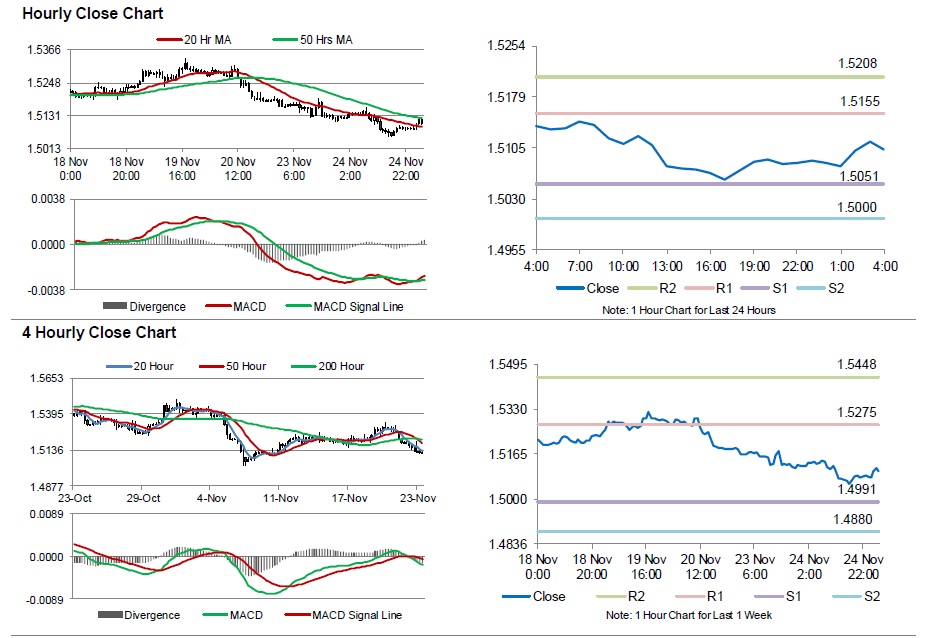

In the Asian session, at GMT0400, the pair is trading at 1.5102, with the GBP trading 0.11% higher from yesterday’s close.

The pair is expected to find support at 1.5051, and a fall through could take it to the next support level of 1.5000. The pair is expected to find its first resistance at 1.5155, and a rise through could take it to the next resistance level of 1.5208.

Moving ahead, market participants will concentrate on UK’s BBA mortgage approvals data for October, scheduled to be released in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.