For the 24 hours to 23:00 GMT, the USD weakened 0.31% against the JPY and closed at 122.52.

In the Asian session, at GMT0400, the pair is trading at 122.34, with the USD trading 0.15% lower from yesterday’s close.

Overnight, the release of BoJ’s October monetary policy meeting minutes revealed that majority of the members believed that Japan’s economy is recovering at a moderate pace. However, most members also felt that the nation’s economy is likely to grow at a slower pace in FY2017 due to sales tax hike. Further, the BoJ pushed back the timing of reaching its inflation target by six months and indicated that the delay in price target was due to weak oil prices, while a few members stated that the bank’s decision partially reflected slow improvement in the output gap.

Early today morning, the BOJ Board Member, Sayuri Shirai, indicated that the central bank can hold off on expanding its stimulus measures to reach its inflation target as robust consumption is likely to make firms more confident about raising prices, and will eventually offset the drag caused by weak oil prices. He further stated that the BoJ is expected to achieve its inflation target of 2.0% by around June 2017, i.e. three months after the central bank board’s official forecast.

In other economic news, Japan’s final leading economic index dropped to a level of 101.6 in September, compared to a reading of 103.5 in the previous month. The preliminary figures had recorded a fall to 101.4. On the other hand, the nation’s final coincident index edged up to a level of 112.3 during the dame month, after recorded a reading of 112.2 in the previous month. The preliminary figures had recorded a drop to 111.9.

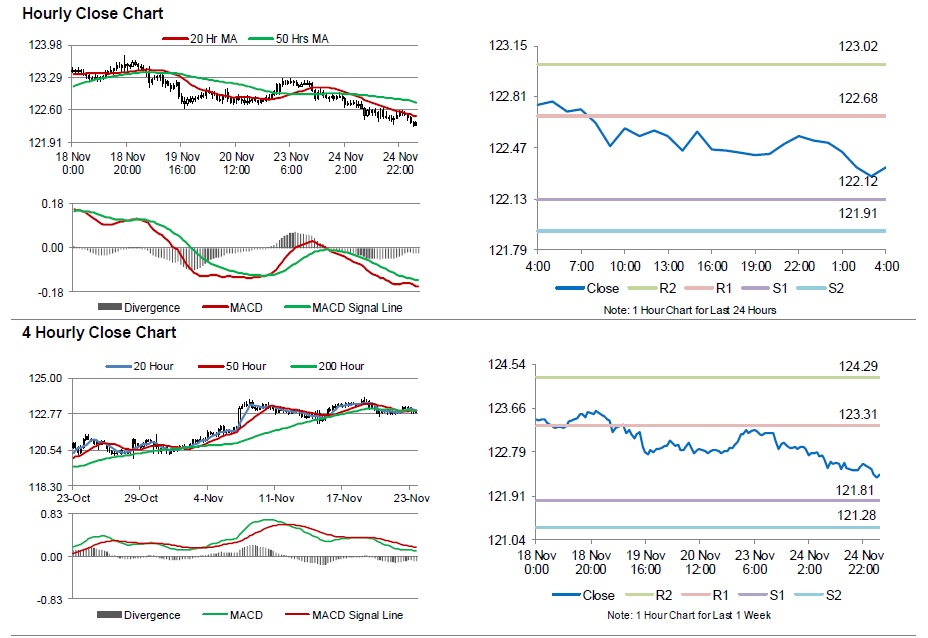

The pair is expected to find support at 122.12, and a fall through could take it to the next support level of 121.91. The pair is expected to find its first resistance at 122.68, and a rise through could take it to the next resistance level of 123.02.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.