For the 24 hours to 23:00 GMT, the GBP rose 0.16% against the USD and closed at 1.5537, as traders digested the release of the BoE minutes from its recent monetary policy meeting.

The minutes showed that the BoE policy makers were unanimous in the decision to keep interest rate steady and at a record low of 0.5% during its latest monetary policy meeting. The vote count was widely expected as the BoE’s quarterly inflation report last week had already indicated members being concerned about the downward risk to inflation.

In the Asian session, at GMT0300, the pair is trading at 1.5554, with the GBP trading 0.11% higher from yesterday’s close.

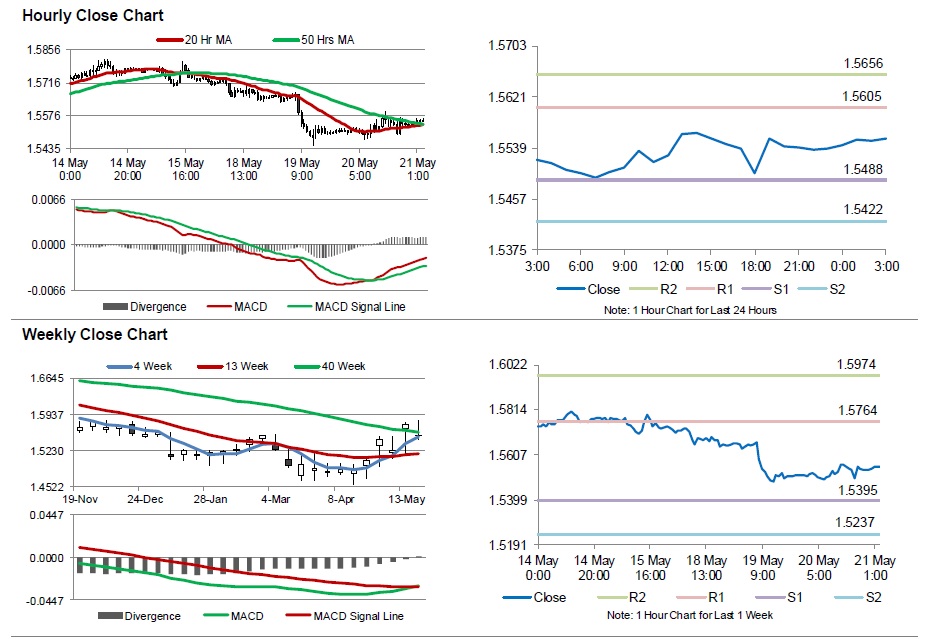

The pair is expected to find support at 1.5488, and a fall through could take it to the next support level of 1.5422. The pair is expected to find its first resistance at 1.5605, and a rise through could take it to the next resistance level of 1.5656.

Going forward, Britain’s retail sales data, scheduled in a few hours, will attract considerable market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.