For the 24 hours to 23:00 GMT, the USD strengthened 0.47% against the JPY and closed at 121.24.

Yesterday, the final leading economic index in Japan advanced to 106.00 in March, compared to a reading of 105.50 recorded in the preceding month, while the coincident index dropped to 109.20 in March, from 109.50 in February.

In the Asian session, at GMT0300, the pair is trading at 121.16, with the USD trading 0.06% lower from yesterday’s close.

Early morning data indicated that Japan’s Markit flash PMI rose to a seasonally adjusted level of 50.9 in May from a final reading of 49.9 in April, thus entering into expansion territory, as output and orders picked up in the nation.

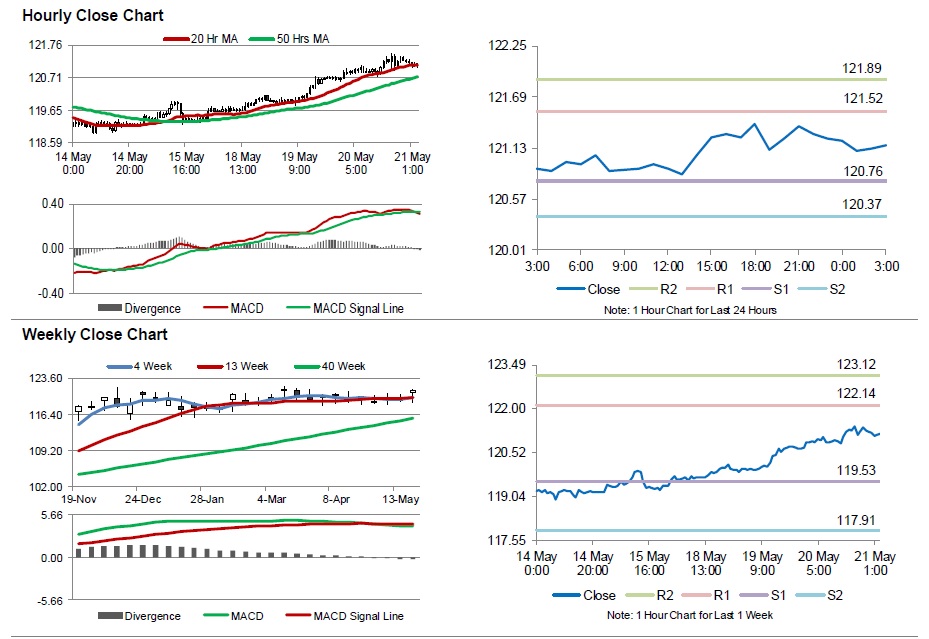

The pair is expected to find support at 120.76, and a fall through could take it to the next support level of 120.37. The pair is expected to find its first resistance at 121.52, and a rise through could take it to the next resistance level of 121.89.

Meanwhile, the BoJ’s interest rate decision along with the central bank’s Governor, Haruhiko Kuroda’s speech, scheduled tomorrow would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.