For the 24 hours to 23:00 GMT, the GBP fell 0.73% against the USD and closed at 1.6095, as house prices in the UK rose less than expected in August, raising concerns over the health of the housing market in the nation. The Halifax house price index rose 0.1%, on a monthly basis in August, lower than market expectations for a rise of 0.3%, following a 1.2% increase in the previous month.

In other economic data, the Lloyds employment confidence index in the nation remained flat at 6.0 in August.

In the Asian session, at GMT0300, the pair is trading at 1.608, with the GBP trading 0.09% lower from yesterday’s close.

Economic data released this morning indicated that like-for-like retail sales in the UK rebounded sharply, increasing 1.3%, on an annual basis in August, higher than market expectations for a rise of 0.3% and compared to a 0.3% fall recorded in the previous month.

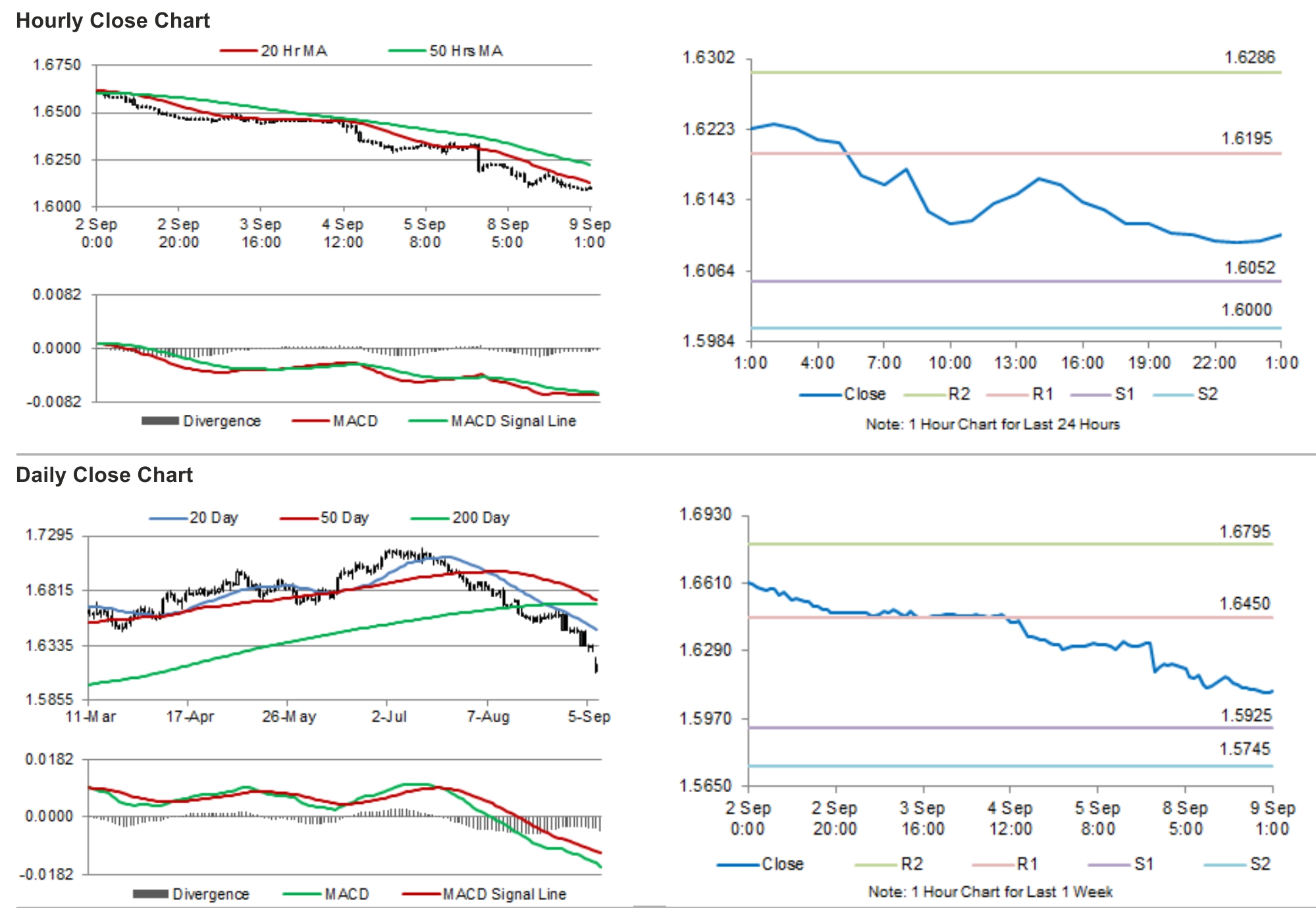

The pair is expected to find support at 1.6029, and a fall through could take it to the next support level of 1.5977. The pair is expected to find its first resistance at 1.6180, and a rise through could take it to the next resistance level of 1.6279.

Trading trends in the Pound today would be determined by the UK’s industrial and manufacturing data, scheduled for release in a few hours. Meanwhile, investors would keep a close eye on the BoE Governor, Mark Carney’s speech, as well as the NIESR’s crucial GDP estimate for the UK, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.