For the 24 hours to 23:00 GMT, the USD strengthened 0.75% against the JPY and closed at 106.00.

In economic news, the Eco Watchers Survey index for the current situation in Japan fell to a level of 47.4 in August, lower than market expectations for a fall to 51.0, while the August index for future outlook dropped to 50.4, compared to a reading of 51.5 in the previous month. Additionally, corporate bankruptcies in the nation recorded a drop of 11.23%, on an annual basis in August, compared to a fall of 13.95% in June.

In the Asian session, at GMT0300, the pair is trading at 106.22, with the USD trading 0.21% higher from yesterday’s close.

Earlier today, the minutes of the BoJ’s latest monetary policy held in August indicated that policymakers are optimistic about Japan’s economic recovery and expect inflation to rise gradually. It also revealed that the central bank would continue with its quantitative and qualitative monetary easing as long as necessary, in order to boost the nation’s economic activity and achieve its 2% inflation target.

In other data, Japan’s tertiary industry index remained flat, on a monthly basis in July, similar to a revised unchanged reading in the prior month. Markets were anticipating the tertiary industry index to rise 0.2%.

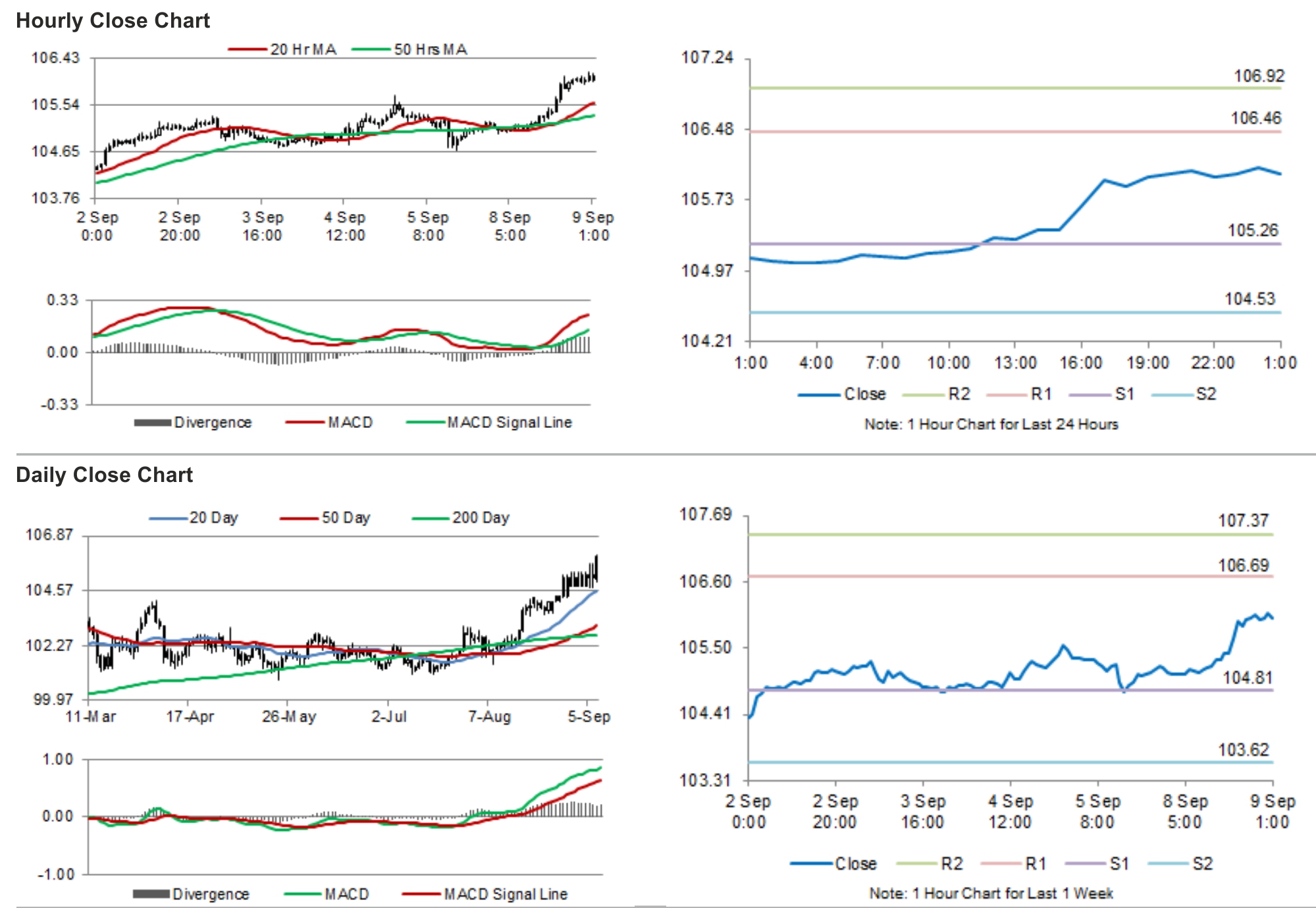

The pair is expected to find support at 105.4, and a fall through could take it to the next support level of 104.57. The pair is expected to find its first resistance at 106.67, and a rise through could take it to the next resistance level of 107.12.

Trading trends in the Yen today would be determined by Japan’s consumer confidence index as well as machine tool orders data, scheduled shortly.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.