For the 24 hours to 23:00 GMT, the GBP fell 0.87% against the USD and closed at 1.6320, after the BoE stuck to its current loose monetary policy, despite two policymakers voting for a rate hike at the last meeting.

The BoE’s Monetary Policy Committee kept the benchmark interest rates unchanged at a record low of 0.5%. It further maintained the total size of its bond portfolio untouched at £375 billion, following their September policy meeting.

In the Asian session, at GMT0300, the pair is trading at 1.6311, with the GBP trading 0.06% lower from yesterday’s close.

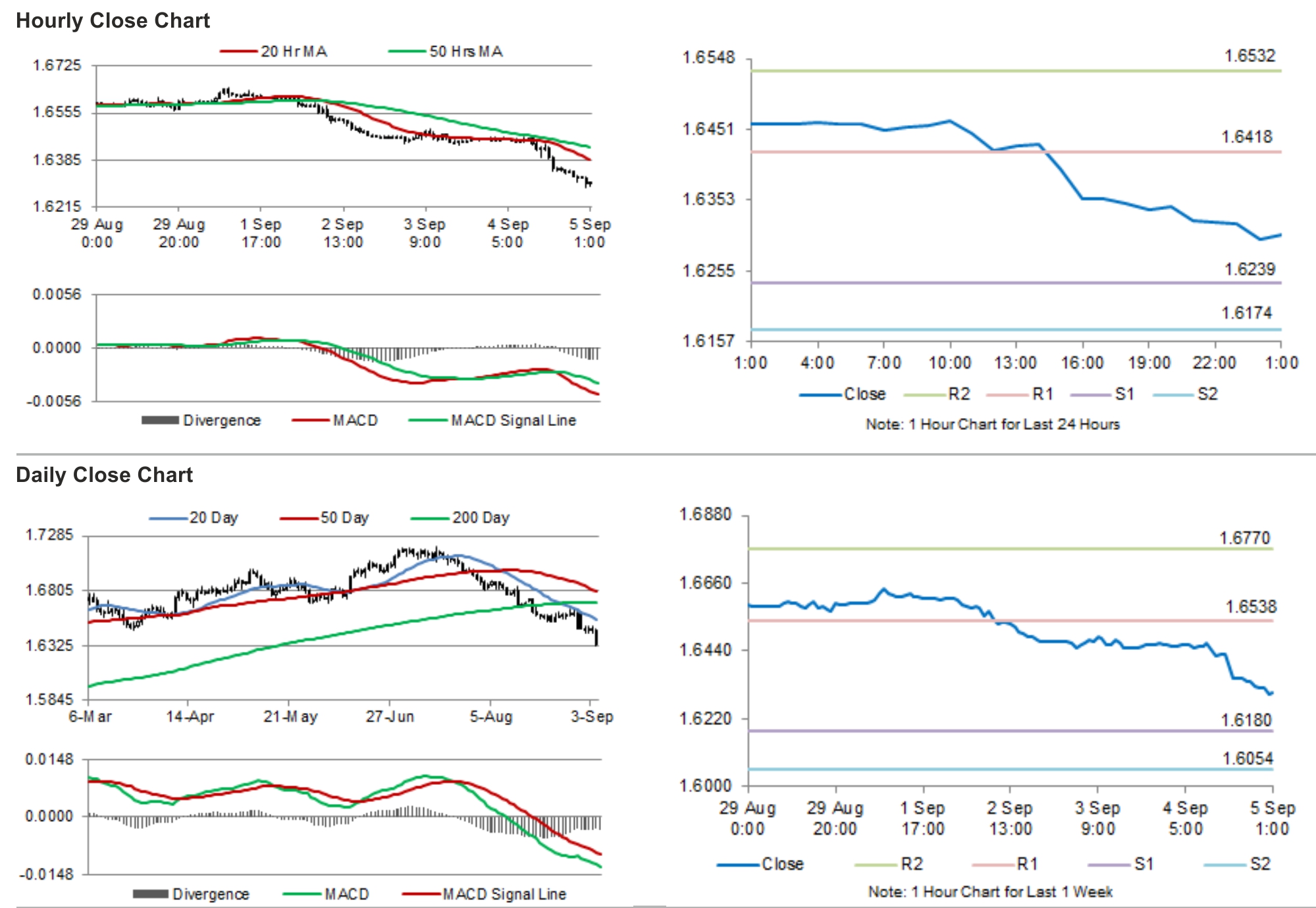

The pair is expected to find support at 1.6243, and a fall through could take it to the next support level of 1.6176. The pair is expected to find its first resistance at 1.6422, and a rise through could take it to the next resistance level of 1.6534.

Going forward, investors would pay attention to inflation expectations from the BoE, scheduled to be released today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.