For the 24 hours to 23:00 GMT, the USD strengthened 0.52% against the JPY and closed at 105.39 amid prospects of higher US interest rates after US economic data continued to be encouraging. The yen also came under pressure after the Bank of Japan indicated no change to its record stimulus yesterday.

In the Asian session, at GMT0300, the pair is trading at 105.34, with the USD trading a tad lower from yesterday’s close.

Early morning data indicated that, in Japan, foreign exchange reserves surplus expanded to $1278.0 billion in August, following a surplus of $1276.0 billion recorded in the previous month.

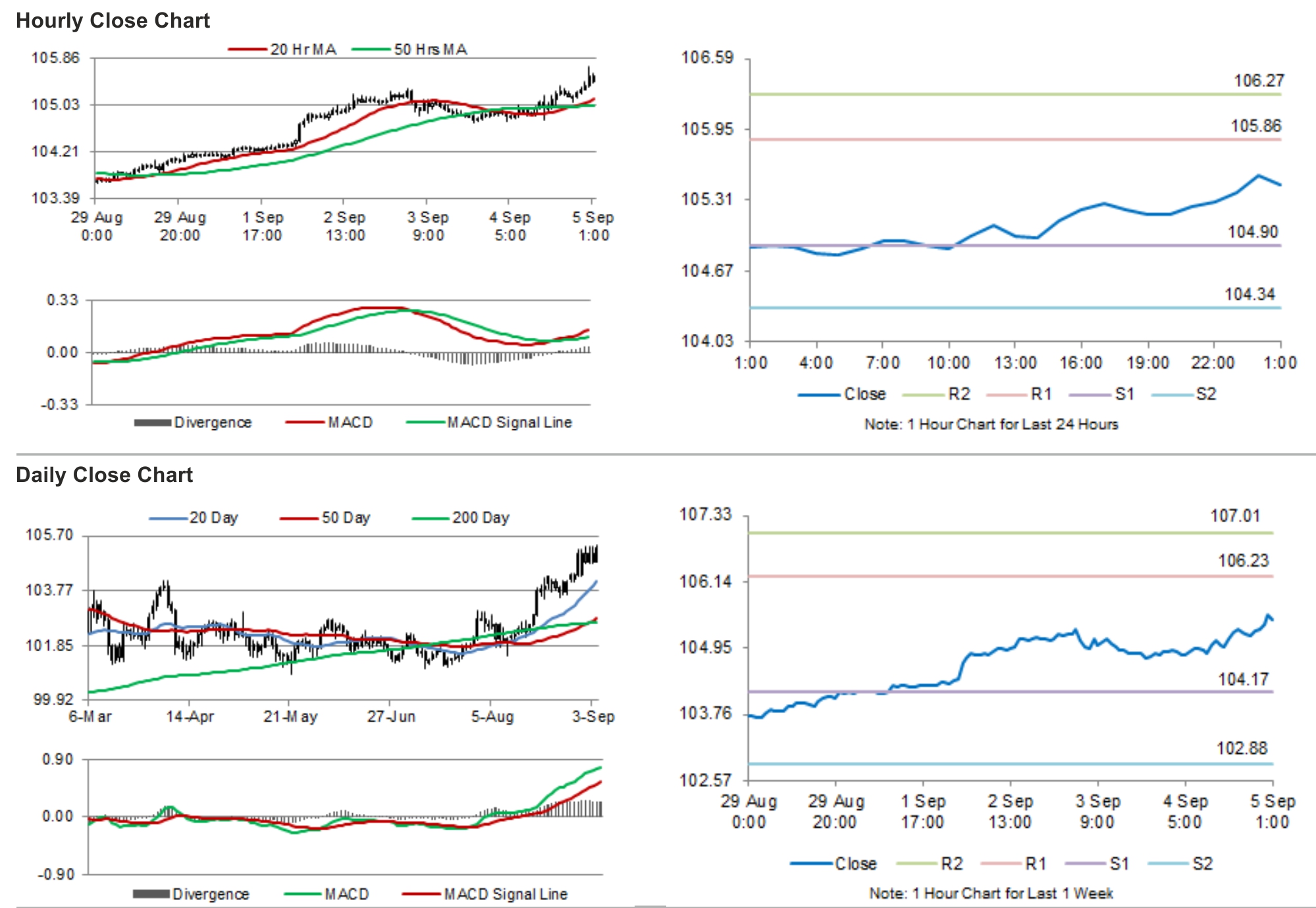

The pair is expected to find support at 104.82, and a fall through could take it to the next support level of 104.31. The pair is expected to find its first resistance at 105.79, and a rise through could take it to the next resistance level of 106.24.

Going forward, investors await the BoJ’s monthly survey, as well as the leading economic and coincident indices data, scheduled shortly.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.