For the 24 hours to 23:00 GMT, the GBP rose 0.18% against the USD and closed at 1.5061.

On the economic front, UK’s net consumer credit rose less-than-expected by £1.2 billion in October, against market expectations for it to remain steady at £1.3 billion. Also, the nation’s mortgage approvals for house purchases advanced to a level of 69.6K in October, compared to a revised reading of 69.0K in the previous month. Markets were anticipating it to advance to a level of 69.9K.

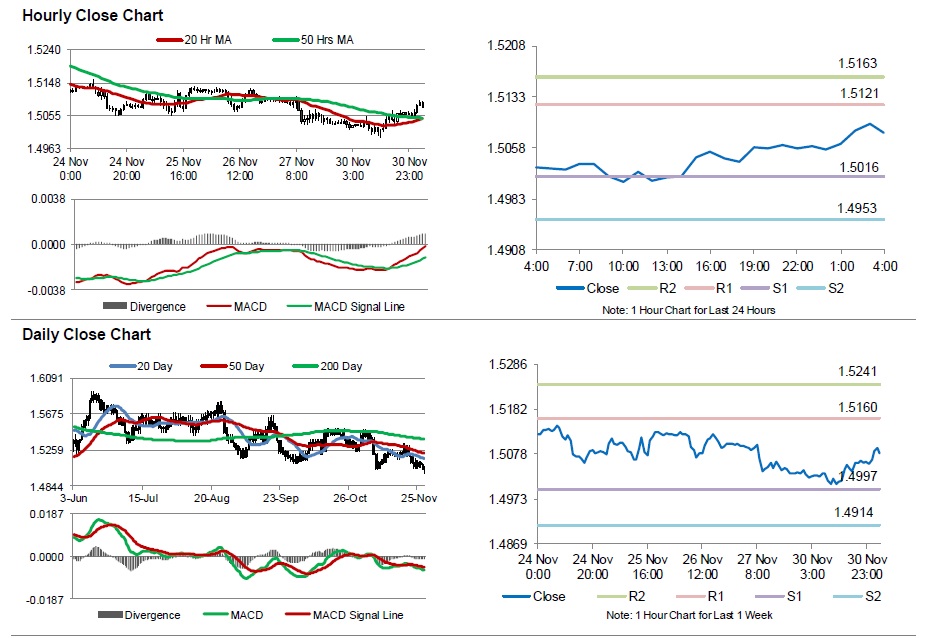

In the Asian session, at GMT0400, the pair is trading at 1.508, with the GBP trading 0.13% higher from yesterday’s close.

The pair is expected to find support at 1.5016, and a fall through could take it to the next support level of 1.4953. The pair is expected to find its first resistance at 1.5121, and a rise through could take it to the next resistance level of 1.5163.

Going ahead, investors will concentrate on BoE’s financial stability report and UK’s Markit manufacturing PMI data for November, scheduled to be released in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.