For the 24 hours to 23:00 GMT, the USD strengthened 0.30% against the JPY and closed at 123.17.

In the Asian session, at GMT0400, the pair is trading at 122.93, with the USD trading 0.19% lower from yesterday’s close.

Overnight data showed that capital spending in Japan surprisingly rose to an annual rate of 11.2% in 3Q 2015, against market expectations for an advance of 2.2%, and after having climbed 5.6% in the previous quarter.

Early this morning, Japan’s Nikkei Manufacturing PMI rose to a level of 52.6 in November, growing at its fastest pace in 20 months, after registering a reading of 52.4 in the previous month. The preliminary figures had indicated an advance to 52.8.

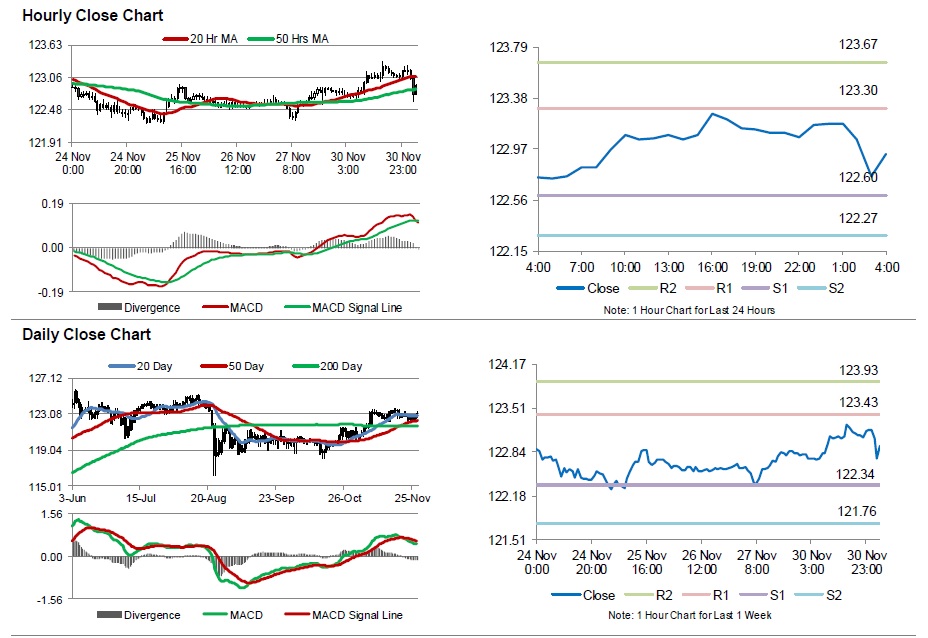

The pair is expected to find support at 122.60, and a fall through could take it to the next support level of 122.27. The pair is expected to find its first resistance at 123.30, and a rise through could take it to the next resistance level of 123.67.

Moving ahead, investors will look forward to the BoJ’s monetary base data for November, scheduled to be released overnight.

The currency pair is trading below its 20 Hr moving average and is showing convergence with its 50 Hr moving average.