For the 24 hours to 23:00 GMT, the GBP rose 0.19% against the USD and closed at 1.6007.

In economic news, construction activity in Britain dropped to a 5-month low level of 61.4 in October, lower than market expectations for a drop to 63.5 and compared to a reading of 64.2 in the previous month, thus dampening investor optimism over the economic outlook of the UK economy.

Yesterday, leading thinktank, the National Institute of Economic and Social Research (NIESR) projected interest rates in the UK to reach 1% from an all-time low of 0.5% by the end of 2015, rising gradually to 2.75% by the end of 2019. According to the NIESR the BoE would wait for the general elections in the nation to be over before thinking of hiking its key interest rates, as the threat of the Euro-zone falling back into recession hangs over the UK economy,

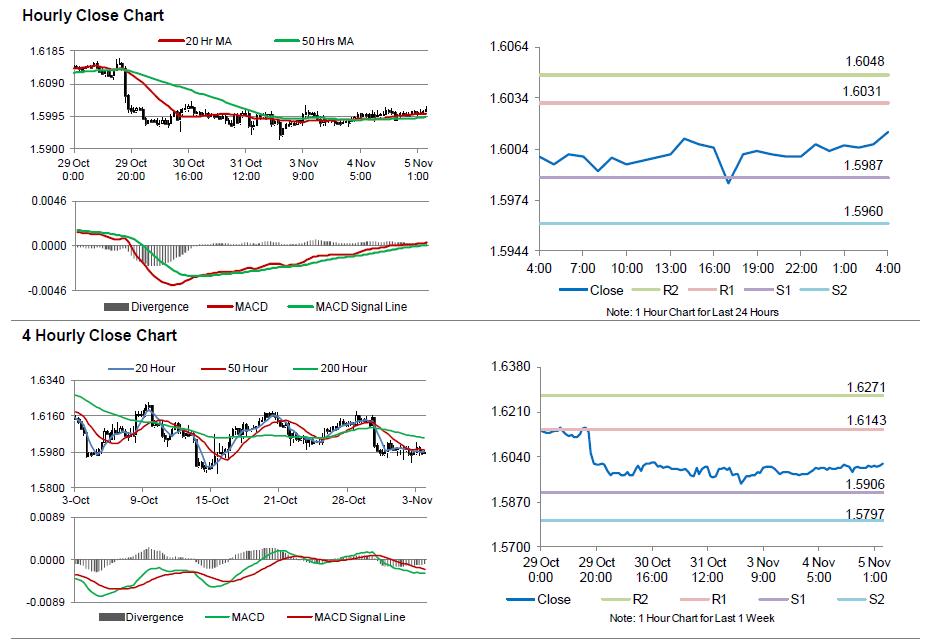

In the Asian session, at GMT0400, the pair is trading at 1.6014, with the GBP trading marginally higher from yesterday’s close.

Early morning data indicated that, the BRC shop price index in the UK eased 1.9% on an annual basis in October, beating market expectations for a fall of 1.7% and following a drop of 1.8% recorded in September.

The pair is expected to find support at 1.5987, and a fall through could take it to the next support level of 1.5960. The pair is expected to find its first resistance at 1.6031, and a rise through could take it to the next resistance level of 1.6048.

Trading trends in the Pound today are expected to be determined by Britain’s services PMI data, set for release in a few hours from now.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.