For the 24 hours to 23:00 GMT, the USD weakened 0.29% against the JPY and closed at 113.46, reversing its previous session gains.

In economic news, Japanese vehicle sales declined 9.1% on a YoY basis in October, compared to a drop of 2.8% registered in September.

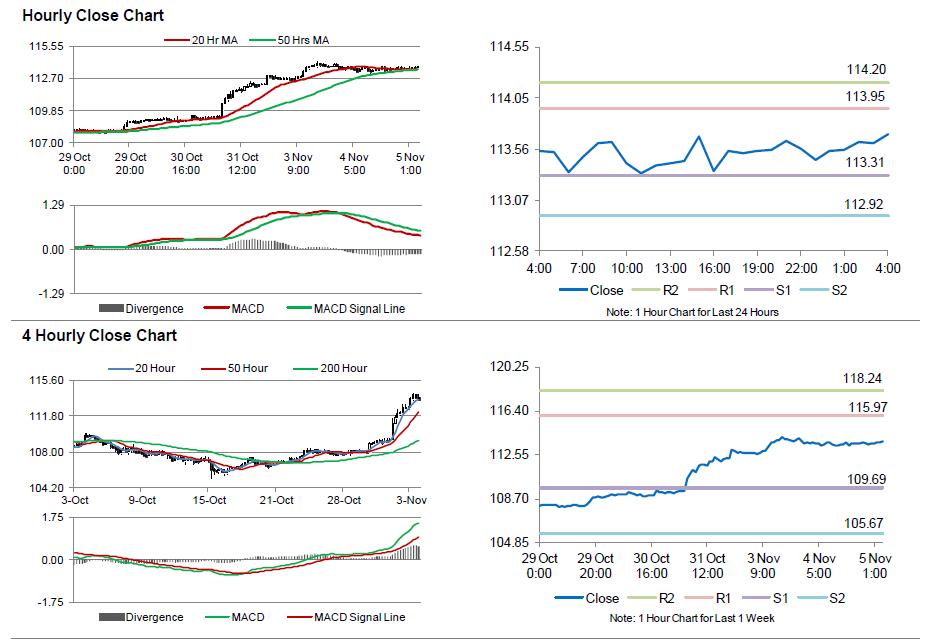

In the Asian session, at GMT0400, the pair is trading at 113.70, with the USD trading 0.22% higher from yesterday’s close.

Earlier today, the BoJ Governor, Haruhiko Kuroda, mentioned that the central bank would achieve its 2% inflation target some time next fiscal year as it had expanded its monetary stimulus. He further indicated that the central bank would not hesitate to ease its monetary policy again if it is not able to achieve its inflation goal.

In other economic news, Japan’s labour cash earnings climbed 0.8% on a YoY basis, in September, meeting market expectations, while it had registered a revised rise of 0.9% in the previous month.

Overnight data indicated that, the monetary base in Japan recorded a rise of 36.9% in October, following a rise of 35.3% recorded in September.

The pair is expected to find support at 113.31, and a fall through could take it to the next support level of 112.92. The pair is expected to find its first resistance at 113.95, and a rise through could take it to the next resistance level of 114.20.

Meanwhile, the BoJ’s minutes from its latest monetary policy meeting would be closely followed by investors, scheduled for release tomorrow.

The currency pair is trading slightly above its 20 Hr and 50 Hr moving averages.