For the 24 hours to 23:00 GMT, the GBP fell 0.28% against the USD and closed at 1.6988, following downbeat retail sales data from the UK. Official data revealed that retail sales rose 0.1% in June, on a monthly basis, as compared to market expectations for 0.3% rise.

Yesterday, the IMF projected the UK economy to grow at a pace of 3.2% in 2014 and 2.7% in 2015 and further added that the nation would maintain its status as one of the world’s fastest expanding major economies. Meanwhile, UK Chancellor, George Osborne stated that the IMF’s decision to upgrade the growth rate of the UK economy indicated more jobs and more security for families in the nation.

In the Asian session, at GMT0300, the pair is trading at 1.6986, with the GBP trading marginally lower from yesterday’s close.

Earlier today, Hometrack reported that house prices rose 0.1%, on a monthly basis in July, its slowest growth since February 2013, as compared to a 0.3% rise in the previous month, thereby suggesting that the Bank of England’s recent measures to cool down the overheating UK housing market are showing its intended results.

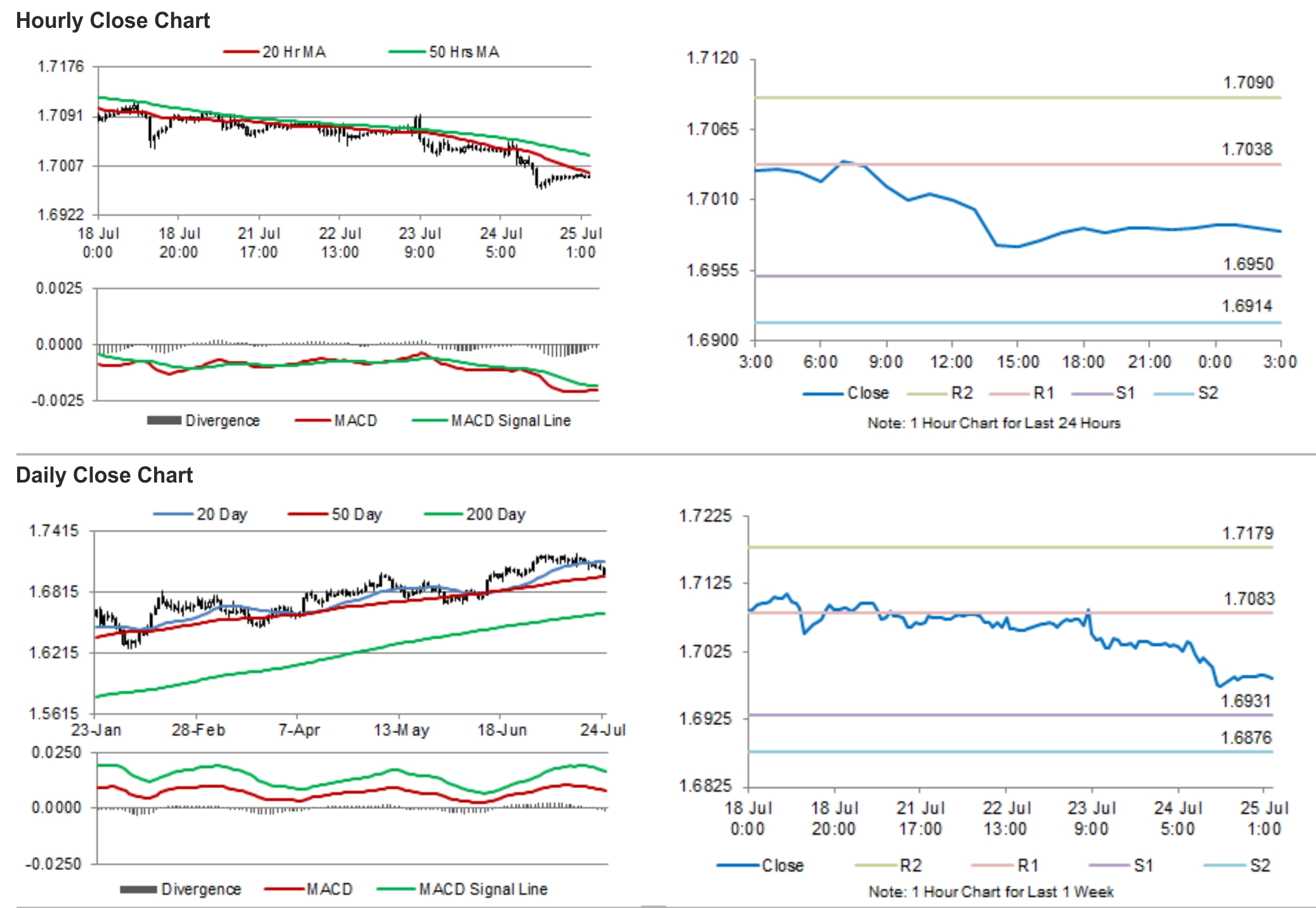

The pair is expected to find support at 1.6950, and a fall through could take it to the next support level of 1.6914. The pair is expected to find its first resistance at 1.7038, and a rise through could take it to the next resistance level of 1.7090.

Trading trends in the Pound today are expected to be determined by the release of the crucial Q2 GDP from the UK, scheduled later in the day.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.