For the 24 hours to 23:00 GMT, the USD strengthened 0.25% against the JPY and closed at 101.79.

Yesterday, the IMF upgraded its economic growth forecasts for Japan to 1.6% in 2014, hinting that the nation made significant progress earlier this year before levy of consumption tax hike from April 1. However, the fund indicated that growth in the world’s third largest economy would decelerate to 1.1% in 2015, mainly due to a further increase in the national consumption tax.

In the Asian session, at GMT0300, the pair is trading at 101.79, with the USD trading flat from yesterday’s close.

In the economic news, Statistics Bureau of Japan indicated that the National Consumer Price Index (CPI) in Japan rose 3.6% in June, on an annual basis, compared to a market estimate of 3.5%. In the previous month, it had seen a rise of 3.7%. Similarly, Tokyo CPI excluding fresh food climbed 2.8% in July, on an annual basis, beating the market expectations for a rise of 2.7%. Tokyo CPI excluding fresh food had registered a similar rise in the previous month. Moreover, the Bank of Japan reported that, on an annual basis, the corporate service price index in Japan rose 3.6% in June, in line with market expectations and a similar increase in the previous month.

Earlier today, the Japanese government cautioned the BoJ to be careful while communicating about its exit from its massive easing policy, in order to avoid the turmoil witnessed when the US Federal Reserve initially disclosed its intention of tapering from its quantitative easing policy.

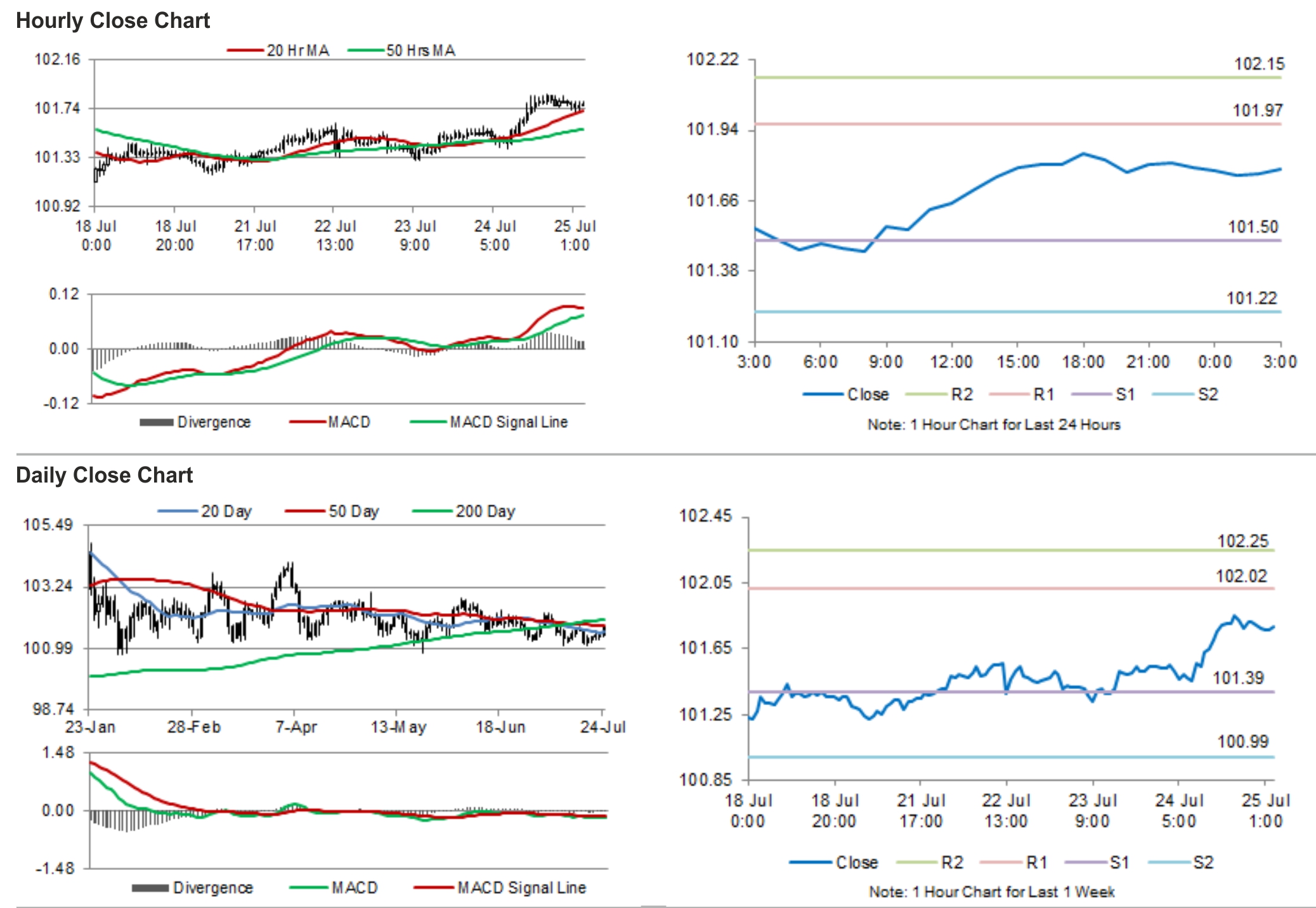

The pair is expected to find support at 101.50, and a fall through could take it to the next support level of 101.22. The pair is expected to find its first resistance at 101.97, and a rise through could take it to the next resistance level of 102.15.

Amid lack of economic releases from Japan, investor sentiments would be determined by Japan’s unemployment rate data along several other indicators, scheduled to be released in the coming week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.