For the 24 hours to 23:00 GMT, the GBP fell 0.14% against the USD and closed at 1.5127, after the minutes of the BoE’s latest monetary policy meeting indicated that that its two dissenting policy makers, Martin Weale and Ian McCafferty switched their views and voted to keep the central bank’s interest rates unchanged along with the other members of monetary policy committee, citing Britain’s tumbling inflation as a major reason and maintained the size of its bond purchases at £375.0 billion.

Losses were kept in check after Britain’s jobless rate slid to a 6-year low of 5.8% in the September-November 2014 period, lower than market expectations of a drop to a level of 5.9% and compared to a level of 6.0% recorded in the August-October 2014 period. However, employment in the UK recorded an increase of 37.0 K in the three month to November, compared to market expectations of an advance of 74.0 K. Meanwhile, the nation’s claimant count rate recorded a drop to 2.6% in December, in line with market expectations. In the previous month, it had registered a level of 2.70%.

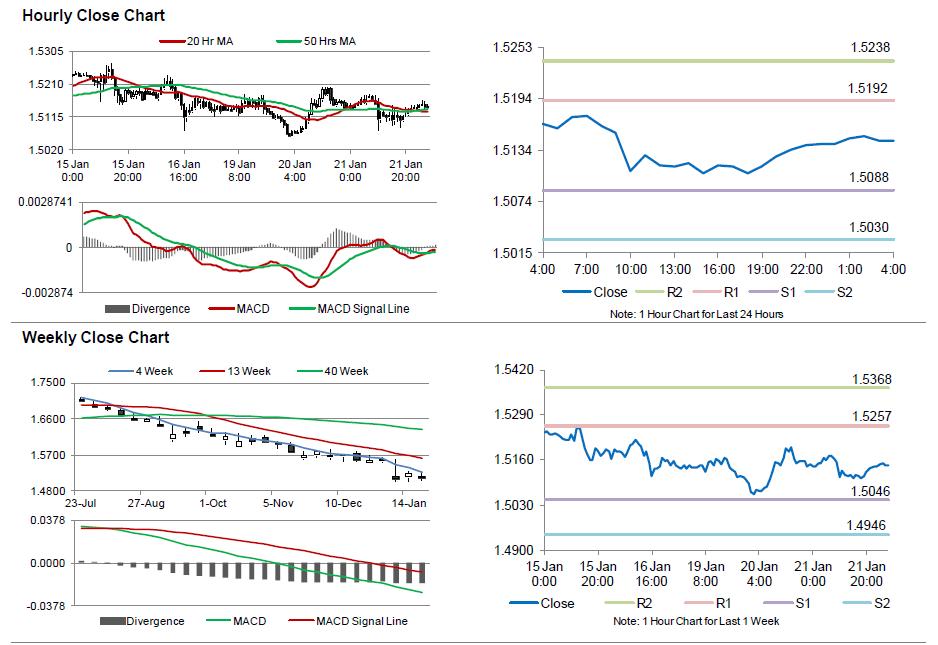

In the Asian session, at GMT0400, the pair is trading at 1.5145, with the GBP trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.5088, and a fall through could take it to the next support level of 1.503. The pair is expected to find its first resistance at 1.5192, and a rise through could take it to the next resistance level of 1.5238.

Trading trends in the Pound today are expected to be determined by the UK’s public sector net borrowing data, scheduled in few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.