For the 24 hours to 23:00 GMT, the USD weakened 0.60% against the JPY and closed at 117.95.

Yesterday, the BoJ Governor, Haruhiko Kuroda, stated that the nation’s economy was continuing to recover gradually and inflation expectations were seen rising over long term. He further added that the central bank would likely reach its 2% inflation target around FY2015, assuming a gradual rise in oil prices.

In other economic news, final machine tool orders in Japan climbed 33.9% on a YoY basis in December. In the prior month, machine tool orders had risen 36.6%.

In the Asian session, at GMT0400, the pair is trading at 118.19, with the USD trading 0.21% higher from yesterday’s close.

Earlier today, the BoJ in its monthly report indicated that the nation’s economy has continued to recover moderately as a trend and effects of decline in demand after a hike in sales tax have been gradually fading on the whole.

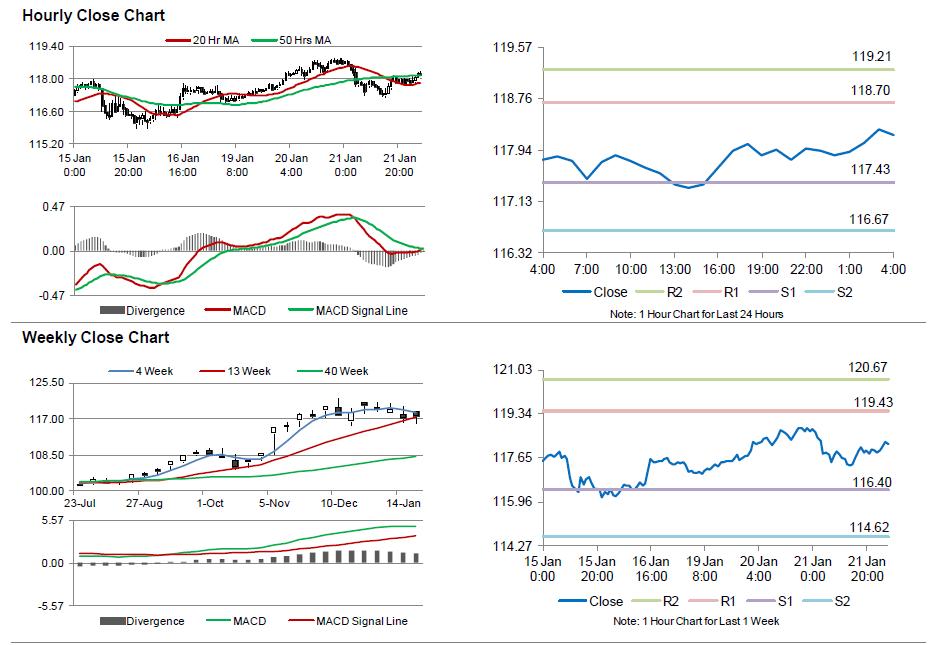

The pair is expected to find support at 117.43, and a fall through could take it to the next support level of 116.67. The pair is expected to find its first resistance at 118.70, and a rise through could take it to the next resistance level of 119.21.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.