For the 24 hours to 23:00 GMT, the GBP fell 0.17% against the USD and closed at 1.6215, despite data revealing that the UK economy grew 0.9%, on a quarterly basis, in 2Q 2014, exceeding market expectations for a rise of 0.8% and compared to a similar increase registered in the previous quarter, thus raising optimism over the health of the nation’s economy.

Additionally, Lloyds business barometer in the nation surged to 57.0 in September, compared to previous month’s reading of 47.0. Meanwhile, Britain’s current account deficit widened to £23.1 billion in 2Q 2014, following a revised deficit of £20.5 billion in the previous quarter. Markets were expecting it to narrow to £18.0 billion. Similarly, the seasonally adjusted nationwide housing prices in Britain unexpectedly eased 0.2%, on a monthly basis, in September, compared to market expectations for a rise of 0.5% and following 0.8% increase registered in the prior month.

Meanwhile, MPC member, David Miles, opined that the BoE should only guide that it would raise the country’s interest rates in “limited and gradual” manner and that the Bank should not give away anything concrete to avoid confusing investors.

In the Asian session, at GMT0300, the pair is trading at 1.6187, with the GBP trading 0.17% lower from yesterday’s close.

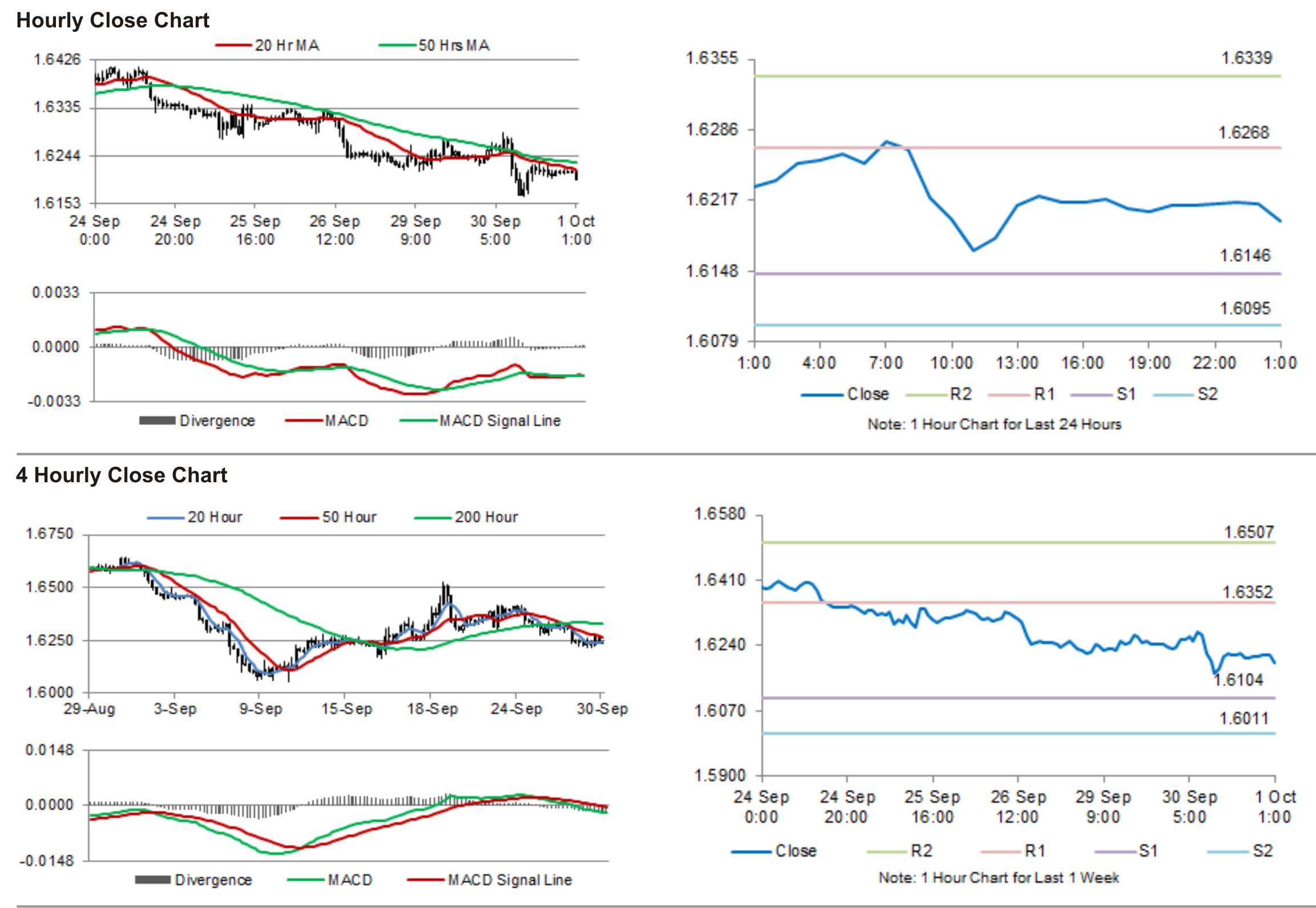

The pair is expected to find support at 1.6139, and a fall through could take it to the next support level of 1.6092. The pair is expected to find its first resistance at 1.6261, and a rise through could take it to the next resistance level of 1.6336.

Trading trends in the Pound today would be determined by the UK manufacturing PMI, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.