For the 24 hours to 23:00 GMT, the USD strengthened 0.21% against the JPY and closed at 109.63.

In economic news, housing starts in Japan eased 12.5%, on an annual basis, in August, less than the market’s expected fall of 14.2% and following a drop of 14.1% registered in July.

In the Asian session, at GMT0300, the pair is trading at 109.96, with the USD trading 0.3% higher from yesterday’s close.

Early morning data indicated that the Japanese PMI remained steady at 51.7 in September. Meanwhile, the BoJ reported that the Tankan large manufacturing outlook index registered a reading of 13.0 in 3Q 2014, in line with market expectations and compared to a reading of 15.0 recorded in the prior quarter.

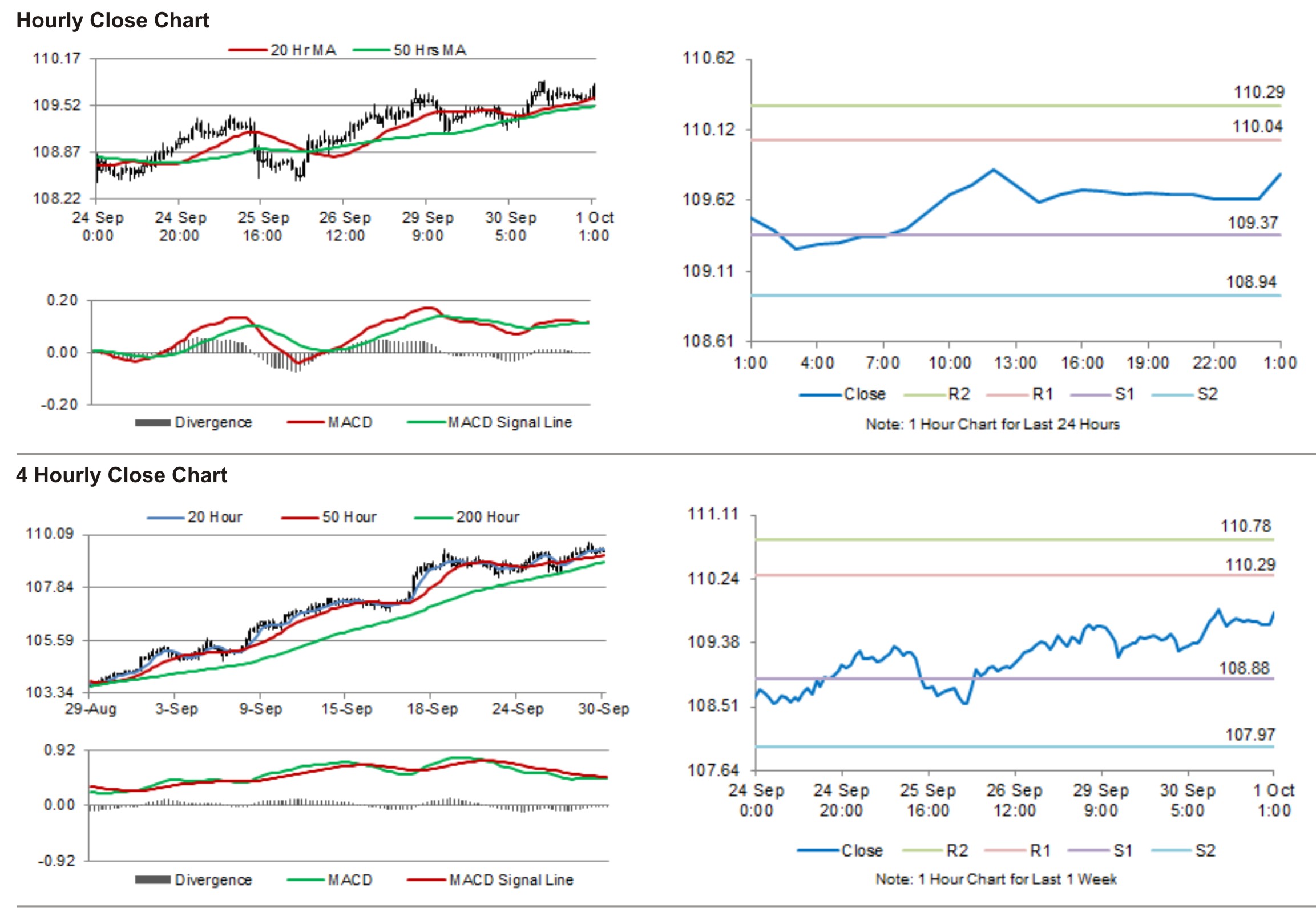

The pair is expected to find support at 109.39, and a fall through could take it to the next support level of 108.83. The pair is expected to find its first resistance at 110.31, and a rise through could take it to the next resistance level of 110.66.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.