For the 24 hours to 23:00 GMT, the GBP fell 0.22% against the USD and closed at 1.6907. The greenback continued to remain supported following the Fed’s monetary policy meeting and upbeat economic growth data from the US.

The British Pound lost ground after the GfK consumer confidence index of the UK slumped for the first time in six months after notching a 10-year high level in the previous month, adding to signs that the spending appetite in the Britain economy is dropping. GfK reported that its headline consumer confidence index fell to -2 in July from 1 in June.

Meanwhile, yesterday a leading broker downgraded its projections for the British Pound against the greenback, stating that the Bank of England can no longer provide positive surprises and hence investors should concentrate more on downside risks.

In another noteworthy development, the BoE introduced its toughest restrictions yet on bonuses in order to stiffen its regulatory clampdown on intentional offence in the nation’s financial sector. According to the new rule, bankers may have to give back bonuses up to seven years after being awarded them, if they resort to any sort of misconduct.

In the Asian session, at GMT0300, the pair is trading at 1.6920, with the GBP trading 0.08% higher from yesterday’s close.

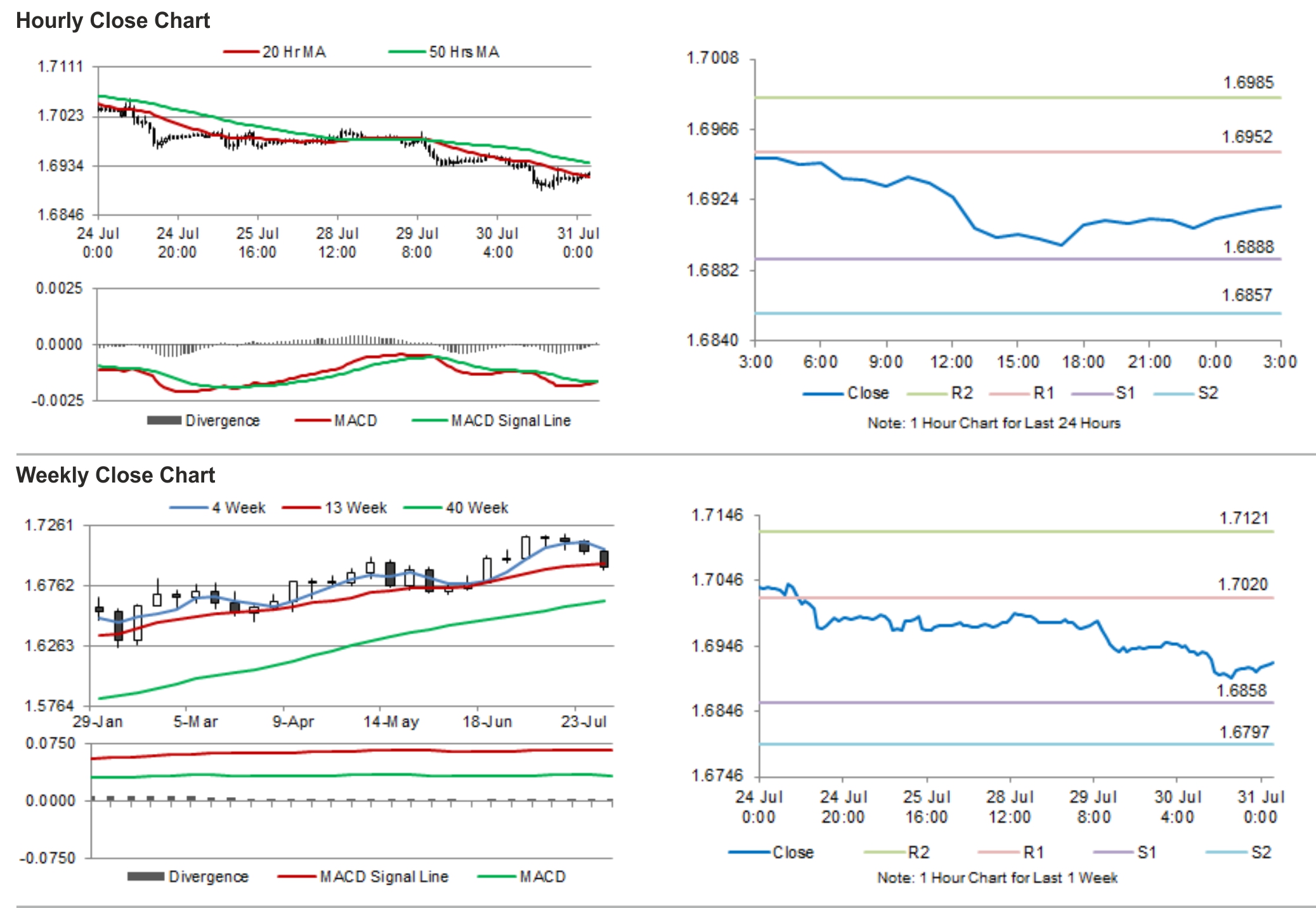

The pair is expected to find support at 1.6888, and a fall through could take it to the next support level of 1.6857. The pair is expected to find its first resistance at 1.6952, and a rise through could take it to the next resistance level of 1.6985.

Trading trends in the pair today are expected to be determined by global events.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.