For the 24 hours to 23:00 GMT, the USD strengthened 0.74% against the JPY and closed at 102.85 following a strong rebound in its economic growth data from the US. Meanwhile, the Fed’s view optimistic view of the US economy also supported the US Dollar.

In the Asian session, at GMT0300, the pair is trading at 102.75, with the USD trading 0.1% lower from yesterday’s close.

Earlier this morning, the Japan Automobile Manufacturers Association (JAMA) reported that, on an annual basis, vehicle production in Japan climbed 6.6% in June, compared to a 6.1% increase in the previous month. Meanwhile, the nation’s labour cash earnings rose lesser-than-expected by 0.4% in June, as compared to market expectations for a 0.8% rise and from a revised 0.6% rise reported in the last month.

Meanwhile, BoJ Board Member Takahide Kiuchi cautioned that the central bank should consider all possibilities before it shifts its focus of its monetary policy to 0% interest rates from asset purchases. Furthermore, he expressed concerns over the prospects of a quick rebound in exports, emphasising the effect of structural changes in Japanese manufacturing and warning of possible slower growth in China.

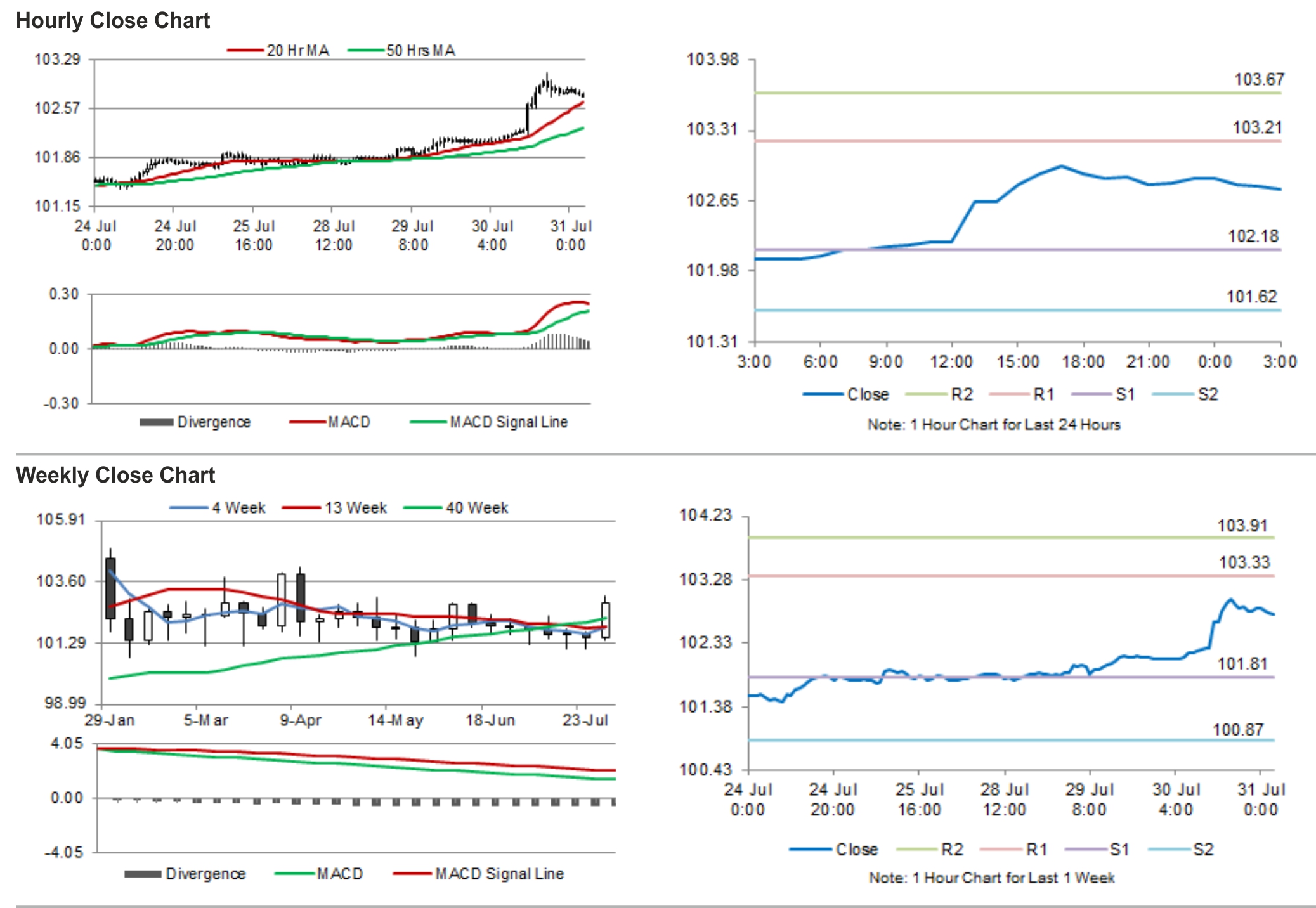

The pair is expected to find support at 102.18, and a fall through could take it to the next support level of 101.62. The pair is expected to find its first resistance at 103.21, and a rise through could take it to the next resistance level of 103.67.

Trading trends in the Yen today are expected to be determined by the release of Japan’s housing starts data, to be out later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.