For the 24 hours to 23:00 GMT, the GBP fell marginally against the USD and closed at 1.6746, as data showed that mortgage approvals in the UK fell for the third-straight month to a nine-month low level of 62,918 in April while lending to individuals and M4 money supply in the economy missed market expectations for April. Likewise, manufacturing activities in British manufacturing sector slowed down in May, dragging its index to a level of 57.0 in May, from a reading of 57.3 in April.

However, BoE’s Deputy Governor, Charlie Bean, in a BBC Radio 4 interview, projected average interest rate in the UK economy to settle at around 3.0% in 2018 or 2019 while indicating that the central bank was very keen on raising its interest rates. Separately, another BoE official, Jon Cunliffe, highlighted the importance of more transparency in asset-backed securities to revive Euro-zone’s market, which was badly hit by the financial crisis.

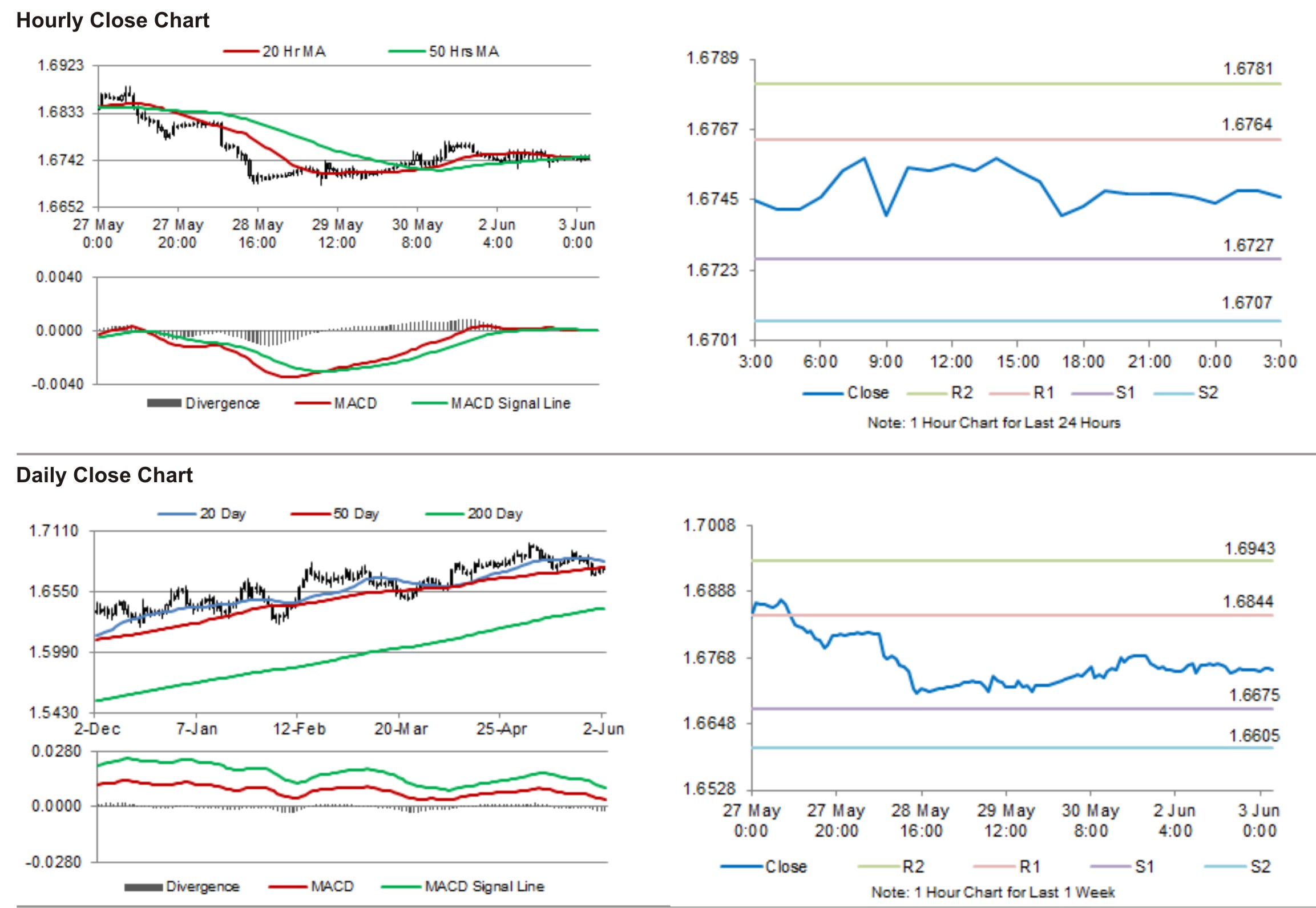

In the Asian session, at GMT0300, the pair is trading at 1.6746, with the GBP trading flat from yesterday’s close.

The pair is expected to find support at 1.6727, and a fall through could take it to the next support level of 1.6707. The pair is expected to find its first resistance at 1.6764, and a rise through could take it to the next resistance level of 1.6781.

Traders are expected to keep a tab on Nationwide housing price data to know the current movements in the UK’s housing market.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.