For the 24 hours to 23:00 GMT, the USD strengthened 0.57% against the JPY and closed at 102.40.

In the Asian session, at GMT0300, the pair is trading at 102.39, with the USD trading a tad lower from yesterday’s close. Earlier today, the BoJ Governor, Haruhiko Kuroda hinted that the central bank would not hesitate to expand its stimulus measures further should risk materialise and make it difficult for the nation to achieve the central bank’s inflation target. Additionally, he also warned against the premature discussion of BoJ’s exit policy, as the central bank’s top priority as of now was to ensure more liquidity in the market in order to assist Japan in its path to achieve 2.0% inflation target.

In economic releases, Japan’s monetary base rose 45.6% (YoY) to a record ¥224.37 trillion in May. Separately, another data showed that total labour cash earnings in Japan increased at a faster annual rate of 0.9% in April.

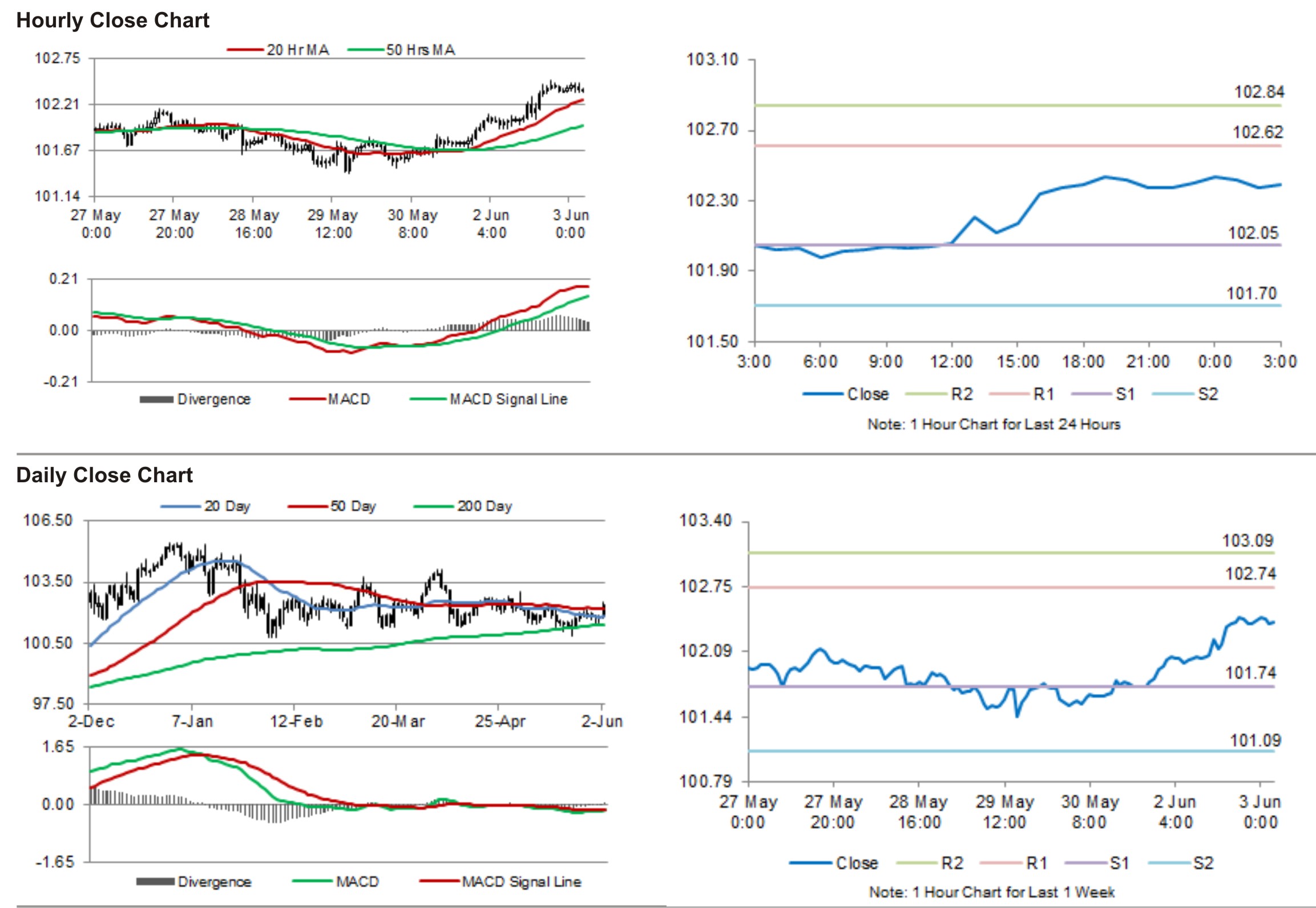

The pair is expected to find support at 102.05, and a fall through could take it to the next support level of 101.70. The pair is expected to find its first resistance at 102.62, and a rise through could take it to the next resistance level of 102.84.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.