For the 24 hours to 23:00 GMT, the GBP declined 0.78% against the USD and closed at 1.4125, after UK’s mortgage approvals registered an unexpected drop in December.

Data showed that Britain’s BBA mortgage approvals declined to its lowest level since April 2013, after it fell to a level of 36.12K in December, intensifying concerns about the health of the nation’s housing market. In the prior month, mortgage approvals had registered a revised level of 39.01K, while markets were expecting for a rise to a level of 39.80K.

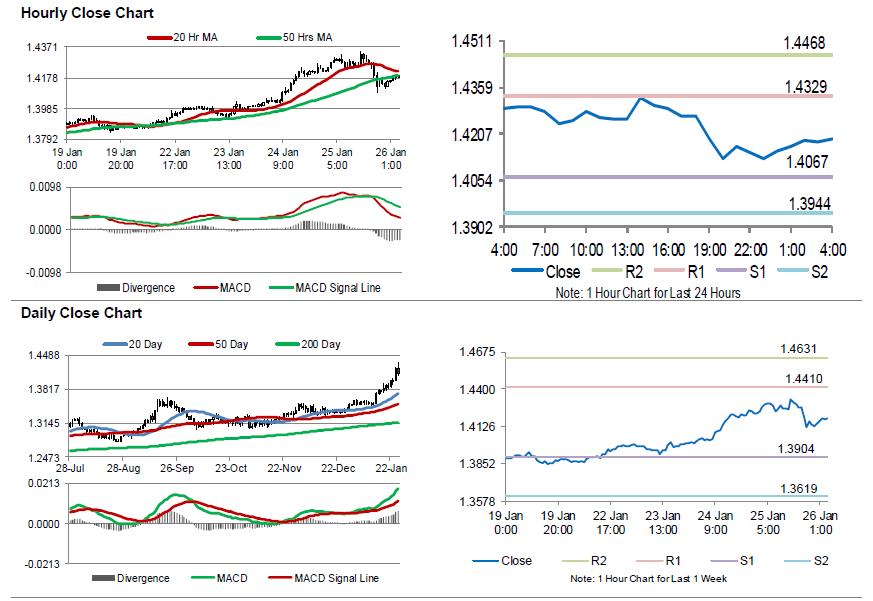

In the Asian session, at GMT0400, the pair is trading at 1.4190, with the GBP trading 0.46% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.4067, and a fall through could take it to the next support level of 1.3944. The pair is expected to find its first resistance at 1.4329, and a rise through could take it to the next resistance level of 1.4468.

Trading trend in the Pound today is expected to be determined by UK’s crucial 4Q GDP data and BoE Governor Mark Carney’s speech, set to release in a few hours.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.