For the 24 hours to 23:00 GMT, the USD rose 0.37% against the JPY and closed at 109.60.

In the Asian session, at GMT0400, the pair is trading at 109.38, with the USD trading 0.2% lower against the JPY from yesterday’s close.

Minutes of the Bank of Japan’s (BoJ) December monetary policy meeting showed that majority of board members believed that it was appropriate to stick to the central bank’s current monetary policy stance as inflation remains far from its 2.0% target. However, some officials expressed a need to consider raising interest rates or reducing purchases of risky assets if the economic recovery continued.

Data released overnight showed that Japan’s national consumer price index (CPI) advanced less-than-anticipated by 1.0% on an annual basis in December, adding to the complication for the central bank as it struggles to boost inflation in the nation. The CPI had registered a gain of 0.6% in the prior month, while markets were expecting for a rise of 1.1%.

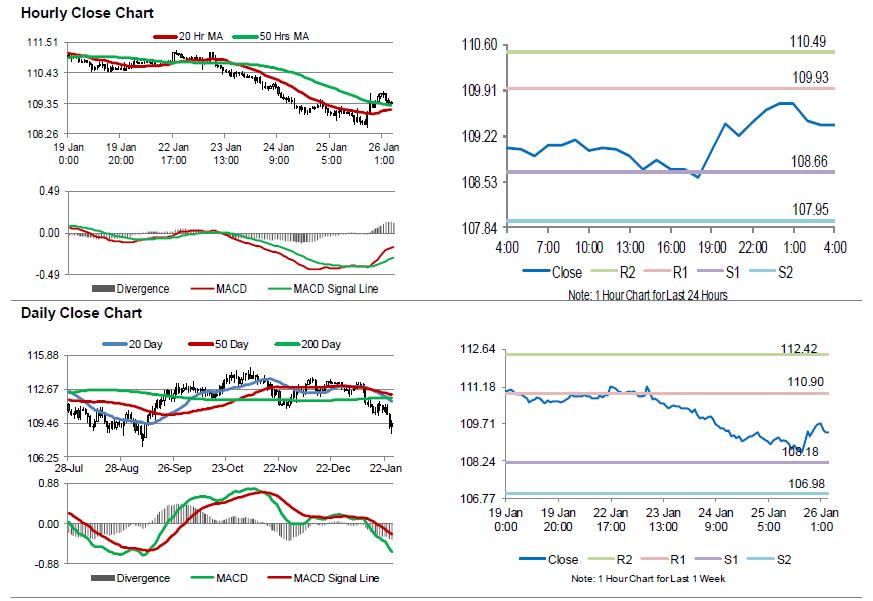

The pair is expected to find support at 108.66, and a fall through could take it to the next support level of 107.95. The pair is expected to find its first resistance at 109.93, and a rise through could take it to the next resistance level of 110.49.

Going ahead, traders would await the release of Japan’s jobless rate, flash industrial production and retail trade data, all due to release next week.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.